Chapter Five: Business Registration in Tanzania – Business Studies Form Five

Introduction

Business registration acts as a gateway towards achieving business performance which subsequently affects economic performance. In fact, countries cannot realize sustainable businesses and economic growth without registering businesses operating in their economies.

In this chapter, you will learn about the concept of business registration, types of business licenses, procedures for registering businesses, and sanctions for non-compliance for medium-sized businesses in Tanzania.

The competences developed will enable you to acquire skills for registering businesses in Tanzania including medium-sized enterprises.

The Concept of Business Registration

Business registration is the process of obtaining legal authorisation to start and operate a business in a given locality. It is sometimes referred to as business formalisation. It involves registering the business, products, properties, documents, intellectual property, and many others.

Business registration does not only pertain to starting the business but also day-to-day business operations. Evidence of business registration is usually in the form of business licenses, permits, and certificates.

Importance of Business Registration

The following are the importance of business registration in Tanzania:

1. Enhances freedom to do business

The government of Tanzania instructs business owners in the country to operate a business with a valid business license issued by the respective Authority. Therefore, for any entity to operate the business freely in Tanzania either Mainland or Zanzibar it is important to be registered to avoid the consequences of operating an unregistered.

2. Increases access to credit

Many financial institutions in the country offer loan access to businesses that have formalised their operations. Businesses that have undergone the formalisation process can use this opportunity to secure funding from financial institutions, government or other formal lenders to expand their operations and hence boost economic developments.

3. Increases market access

A registered business increases the level of trust to its customers, channel members and general public. Registration of a business has an implication to a third party that the relevant authorities have endorsed the business activities and it is safe to transact/interact with such business. It is that trust which helps a registered business to penetrate various markets. In addition, it enables a medium-sized business to bid for lenders in the private and public sectors.

4. Enables protection of intellectual property rights

Intellectual property (IP) registration enables companies to protect their core business as well as research and development activities. Apart from protecting businesses, Intellectual property registration also helps companies build value. This is because Intellectual property is typically counted as an asset when assessing a company’s value. As a result, Intellectual property assets can even be used as collateral for loans.

5. Improves tax administration

The sharing of information between BRELA or BPRA and Tanzania Revenue Authority (TRA) or Zanzibar Revenue Authority (ZRA) ensures that all registered and operating businesses in the country pay taxes. By formalising the business, the tax administration burden is significantly reduced as fewer resources are allocated to search for those businesses that are informally operating in the country.

6. Increases of tax base

More registered businesses expand the accessibility of collecting tax across more entities. Every registered business at BRELA or BPRA or any other authority reflects the same increase in the number of tax payers in the TRA or ZRA. If more businesses formalise their operations, the same effect will be reflected on the tax base, hence increase the revenue collected by tax authorities.

7. Assists in the acquisition of property rights

Business formalisation allows the business in the acquisition of property. By using its registered business name, the business may acquire large investments such as land or properties, something which can be limited in the case of unregistered businesses.

8. Helps in the planning process

Business formalisation helps the government and businesses during the planning process. With formal businesses, the government can estimate the amount of revenue to be collected, the cost of collection, allocation of social services, infrastructure, and levies. Similarly, business owners can easily estimate the amount of tax liable each year and plan for payment.

Activity 1

Visit a nearby business licensing authority and request for a list of registered medium-sized businesses in the locality. Thereafter, consult at least three owners of those businesses and ask them about the benefits of registering their businesses.

Exercise 1

- Describe the aspects involved in registering the businesses.

- Why should a business undertake registration?

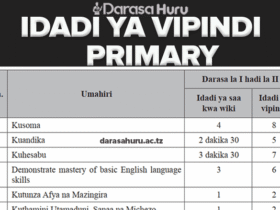

Types of Business Licenses

Business registration of either a medium-sized or other forms of business in Tanzania is a multifaceted phenomenon as demonstrated in Figure 5.1. Moreover, business registration depends on the form of the business (size, business organisation, and products), type of sector, locality (Tanzania Mainland versus Zanzibar), ownership (local versus foreign), location (rural versus urban), and many other factors. Based on the Tanzania Small and Medium Enterprise (SME) Development Policy of 2003, capital invested and number of employees are criteria used in determining the category of businesses when the businesses including medium-sized enterprises are registered.

General Licenses

These are broad permits, licenses or certificates issued to business enterprises by the LGAs, BRELA, or BPRA or their agencies. They are expected to be acquired by a business after applying for the sectoral business licenses. Some of the general licenses include the following:

This license is usually issued upon registering the business. It is the authorisation given by the business licensing authorities to start and operate a business. In Tanzania Mainland, business licenses are classified into two classes, that is Class A and Class B. Class A business licenses are those issued by the Ministry of Industry and Trade (MIT) through the Business Registrations and Licensing Agency (BRELA) whereas Class B licenses are issued by Local Government Authorities (LGAs). Examples of business licenses issued by BRELA are in Table 5.1.

| Business Category | Examples |

|---|---|

| Real Estate | Estate Agent, Estate Developer, Property Managements, Real Estate Agent |

| Shipping and Cargo | Shipping Agency, Shipping Business, Cargo Valuation, Cargo superintendence, Harbours and Cargo Handling |

| Financial Services | Banking and Financial Institutions, Capital Market, Microfinance Institutions, Insurance and Assurance |

| Tourism | Tourist Hotels, Lodges, Camps, Tour Operators, Hunting Safaris, Travel Agent |

| Transportation | Transportation of Passengers or goods by Air, Transportation of Passengers and goods by railway |

| Telecommunications | Fax, Telex, E-mail, Internet Services Provider, Telecommunication Services |

| Mining and Energy | Mining and Gas Drilling, Mineral and Gas Survey, Electricity Production and Distribution |

| Manufacturing and Trade | Manufacturing and selling, Import and selling, Export and selling |

In Zanzibar, BPRA is responsible for registering companies, firms (partnership and sole proprietorship), civil society, corporative society and public corporations. In issuing business licenses, BPRA has grouped all businesses into 21 sectors (A to U) as shown in Table 5.2 which are later classified into various sub-sectors, business activity groups, and business activity class.

| Sector Code | Sector Description |

|---|---|

| A | Agriculture, forestry, and fishing |

| B | Mining and quarrying |

| C | Manufacturing |

| D | Electricity, gas, steam, and air conditioning supply |

| E | Water supply; sewage, waste management |

| F | Construction |

| G | Wholesale and retail trade; repair of motor vehicles and motorcycles |

| H | Transportation and storage |

| I | Accommodation and food service activities |

| J | Information and communication |

| K | Financial and Insurance activities |

| L | Real estate activities |

| M | Professional, scientific, and technical activities |

| N | Administrative and support service activities |

| O | Public administration and defense; compulsory social security |

| P | Education |

| Q | Human health and social work activities |

| R | Arts, entertainment, and recreation |

| S | Other service activities |

| T | Activities of households as employers; undifferentiated goods and services producing activities of household for own use |

| U | Activities of extraterritorial organisations and bodies |

For companies to run day-to-day operations, they need to be registered or incorporated in the list of the Company Registrar as per the Company Act of 2002 in Tanzania Mainland and the Companies Act of 2013 in Zanzibar. In Tanzania Mainland, a Company registration certificate (Certificate of Incorporation) is issued by BRELA whereas in Zanzibar it is issued by BPRA.

This is issued to individuals, partnerships, or corporations to exclusively that register a trading name with the licensing authority. An individual business name is owned by one natural person or legal person; a business name for partners is owned by more than one natural person(s) and/or legal person(s) and a business name for a corporation is owned by a corporate body. BRELA and BPRA are responsible for registering business names in Tanzania Mainland and Zanzibar respectively.

This is provided to foreign companies that have been established, registered, and operate in other countries. To operate also in Tanzania, they need to have a Certificate of Compliance. This certificate is awarded by the BRELA and BPRA to those foreign companies that intend to open their branches and operate in Tanzania Mainland and Zanzibar.

Taxpayer Identification Number (TIN) is a unique tax identification number for individuals, firms or companies. In Tanzania Mainland, upon a company’s registration and acquisition of its incorporation number, the business is also required to have a TIN, which is granted by the Tanzania Revenue Authority (TRA). Nonetheless, for the process to be fully completed and to obtain the original TIN Certificate, the company must submit the requisite forms and documentation to the relevant tax authorities.

This is a certificate issued by the Tanzania Revenue Authority (TRA) to businesses that are required to charge and remit Value Added Tax (VAT). The VAT certificate is issued to businesses that are involved in the provision of taxable goods and services such as lawyers, accountants, and engineers. As at the year 2024, it is also required by businesses with an annual turnover which meets a registration threshold of at least TShs. 200 million and TShs. 100 million in Tanzania Mainland and Zanzibar respectively.

Holders of certificates of incentives are entitled to various investment incentives. In Tanzania Mainland, the Tanzania Investment Centre (TIC) is in charge of issuing incentive certificates. For Zanzibar, the Zanzibar Investment Promotion Authority (ZIPA) is responsible for the issuance of incentive certificates. In both cases of TIC and ZIPA, a one-stop Centre for acquiring most licenses has been established. The investment incentives are given to the companies depending on the given conditions by TIC and ZIPA.

Good health and safety of all workers in any country are key factors necessary for improving productivity. It is therefore the responsibility of the government, employers, and workers to ensure that all workplaces including medium-sized businesses are safe and in a healthy state. To ensure health and safety, governments put in place regulations that protect workers from traditional work hazards as well as new hazards associated with technological changes.

This is a certificate issued by the Fire and Rescue Force to certify that a business premises comply with fire safety regulations. It ensures that the business has adequate fire safety measures in place to protect employees, customers, and property.

Apart from different business licenses, certificates or permits that the businesses need to possess to start business operations, business owners (employers) have to register their employees with pension funds. Pension funds play a crucial role in securing the financial future of employees, including in the context of medium-sized businesses.

In Tanzania Mainland, the National Social Security Fund (NSSF) and the Public Service Social Security Fund (PSSSF) are institutions responsible for managing pension contributions. NSSF serves private sector employees while PSSSF serves public sector employees. In Zanzibar, the Zanzibar Social Security Fund (ZSSF) serves both in public and private sector employees.

This is a permit that is issued to non-citizens in Tanzania. For Tanzania Mainland, the Commissioner of Labour is responsible for issuing work permits to non-citizens, while in Zanzibar work permits are issued by the Labour Commissioner of Zanzibar. Non-citizens who need to work in different sectors including the business sector need to have a work permit. There are five categories of work permits, from class A up to E.

Class A is issued to investors and the self-employed; Class B is issued to those possessing prescribed professions (medical and health care professionals, experts in oil & gas, teachers and university lecturers in science and mathematics); Class C is issued to other professions, Class D is issued to employees or foreigners engaged in approved religious and charitable activities and Class E is issued to refugees.

This is the permit issued to non-citizens intending to live in Tanzania. It is issued by the Commissioner General of Immigration Services in Tanzania Mainland and Zanzibar. There are three types of residence permits ranging from Class A to C. Class A permit may be granted to non-citizens who intend to enter or remain in the United Republic of Tanzania and engage in trade, business, professional activities, agriculture, animal husbandry, mineral prospecting or manufacturing.

Class B permit may be issued to a foreigner who has obtained specified employment in the United Republic of Tanzania, and has been issued with a work permit by the Labour Commissioner. Class C permit may be issued to foreigners intending to enter and reside in Tanzania for purposes other than those specified for the grant of residence permit Class “A” or “B”. These include: students, researchers, volunteers, persons attending cases in Courts of Law, former employees winding up affairs, and persons attending medical treatment.

There are various types of intellectual property rights in Tanzania Mainland and Zanzibar that are important in protecting business secrets, industrial designs, and other forms of intellectual property.

| Intellectual property type | Tanzania Mainland Administered | Zanzibar Administered |

|---|---|---|

| Copyright | Copyright Society of Tanzania (COSOTA) | Office of Copyright Society of Zanzibar (COSOZA) |

| Patents | BRELA or African Regional Intellectual Property Organisation (ARIPO) | BPRA or ARIPO |

| Trademarks | BRELA or ARIPO | BPRA or ARIPO |

| Industrial designs | ARIPO | ARIPO |

Sectoral Licenses

These are sector-specific permits, licenses or certificates issued to business enterprises by sector ministries or their agencies. The majority of these are expected to be acquired by a business before applying for the general business licenses. In some instances, during the application for a business either to the LGAs, BRELA, or BPRA it is mandatory to acquire a sectoral license to operate such business.

Some of the sectoral licenses include the following:

1. Tourist Agency License (TAL)

This license is issued by the Ministry of Natural Resources and Tourism for tourist businesses including hotels, lodges, tourist agents, tour operators, car rental, car hire, hunting safaris, photographic safaris, and tourist campsites.

2. Insurance license

This license is issued by Tanzania Insurance Regulatory Authority (TIRA) for insurance and assurance businesses like insurance brokers, insurance agents, underwriting and loss assessment.

3. Banking license

This license is issued by the Bank of Tanzania (BOT) for businesses dealing with banking, foreign exchange, financial services agency, and microfinance.

4. Capital exchange and stock licenses

These licenses are issued by the Capital Markets and Securities Authority (CMSA) for stock exchange brokerage businesses.

5. Telecommunication and broadcasting licenses

These licenses are issued by the Tanzania Communication Regulatory Authority (TCRA) for the telecommunication businesses services in the country.

6. Mining licenses

These licenses are issued by the Ministry of Minerals for the businesses of minerals legislation, reconnaissance or mineral inspection, mineral prospecting and mining.

7. Explosive dealers license

This license is issued by the Ministry of Minerals for the businesses of provision of explosive services to mining sites and mining companies.

8. Customs Agency License (CAL)

This license is issued by TRA for the businesses of clearing and forwarding, bonded warehouses, and Inland Container Depots (ICDs).

9. Medicine and medical devices permit

This license is issued by the Tanzania Medicines and Medical Devices Authority (TMDA) for the businesses of drugs or medicines, cosmetics, medical devices, pharmaceuticals and narcotic products.

10. Industrial License

This license is issued by BRELA for the businesses of processing, and manufacturing in heavy or light industries.

11. Shipping License

This license is issued by Tanzania Shipping Agencies Corporation (TASAC) for the businesses of shipping, shipping agents, port and harbour operators, cargo tallying and evaluation, cargo handling and water sport facilities.

12. Land transport license

This license is issued by Land Transport Regulatory Authority (LATRA) for the land transportation businesses including railway operators, freight forwarders, cargo consolidation and de-consolidation, railway transportation, road transportation of passengers and goods.

13. Air worthiness certificate and permits

These certificates and permits are issued by Tanzania Civil Aviation Authority (TCAA) for the air transportation businesses including, air charter, aerial work services, air balloon services and ground handling services.

14. Merchant license

This license is issued by Tanzania Ports Authority (TPA) for the businesses of ship chandlers, miscellaneous port services, stevedoring and lighterage.

15. Electricity license

This license is issued by Energy and Water Utilities Regulatory Authority (EWURA) for electricity production and supply businesses like electrical contractors and electricity standby generators.

16. Petroleum dealers license

This license is issued by EWURA for the businesses of refining crude oil, import and sale of petroleum products, wholesale of petroleum products and retail sale of petroleum products.

17. Water dealers license

This license is issued by EWURA for the businesses of water production and supply, water sewerage services, water sales and marketing, sewerage transmission and disposal.

18. Water drilling permit

This permit is issued by Ministry of Water for businesses of water drilling and supply.

19. Gaming license

This license is issued by the Gaming Board of Tanzania for gaming businesses like casinos, slot machines, lottery and betting games, manufacture of gaming equipment, sale and distribution of gaming equipment and accessories.

20. Ammunition dealers’ license

This license is issued by Tanzania People’s Defence Forces (TPDF) for businesses dealing with arms and ammunition.

21. Crop board permits

These permits are issued by the respective Crop Boards for businesses dealing with agricultural crops such as cashew nuts, cotton, sisal, tea, coffee, tobacco, sugar, cereals, and pyrethrum.

22. Export permits

These permits are issued by the Ministry of Agriculture for the businesses of exporting agricultural produce.

23. Professional certificates

These certificates are issued by the respective professional boards for businesses of providing professional services such as accountants (National Board of Accountants and Auditors), contractors (Contractors Registration Board), engineering (Engineers Registration Board), running hospitals, dispensaries, law offices, pilots, and ship captains.

Activity 2

Visit a nearby place where different business activities are conducted:

(a) Identify at least three medium-sized businesses that are conducted in that area;

(b) Categorise the businesses identified in part (a) into their respective sectors; and

(c) Describe the types of licenses that the businesses identified in part (b) need to possess.

Exercise 2

- Why is business registration a multifaceted phenomenon in Tanzania?

- Describe the sectoral licenses which medium-sized businesses are supposed to comply with.

Procedures for Registering Businesses

The procedures of registering businesses including medium-sized enterprises vary depending on the type of license being sought and locality of operation in Tanzania Mainland and Zanzibar. However, the general procedures for issuing a business license, registering a business name and company, acquiring a TIN number are almost similar in both Tanzania Mainland and Zanzibar.

Moreover, the procedures for sectoral licenses differ from one sector to another. The following section provides details on registration processes at the level of the LGAs, BRELA, BPRA, TRA, and ZRA. Most applications are done online.

Procedures for Business Name Registration

The following are the procedures for registering business names:

The applicant creates an online account via BRELA or BPRA website if they do not have one. Once an account is created the applicant will select the ‘registration of business names’ option from the ‘our-services’ menu provided online.

Before commencing the new business registration process, the applicant must perform a name clearance exercise online whereby he or she assesses other business names registered with the agency which are similar to theirs.

Once satisfied that there are no similar names, the registration process begins. In registering the new business, the applicant is supposed to prepare the application. The details to be filled in the application form depend on the type of entity being registered.

The applicant will be obliged to upload the attachments.

Once documents are successfully uploaded a control number will be generated for payment. Payment includes payment for registration fee and annual maintenance fee.

Once payment is received the applicant will submit the application.

In case there are corrections in the submission, the applicant will get feedback of areas requiring corrections. If there are no corrections then the applicant will receive an approval and certificate with the business name and the business extract that has director’s details.

Procedures for Company Registration

The following are procedures for company registration:

(a) Creating an account through Online Registration System (ORS)

The applicant acting on behalf of the company being registered creates an online account via BRELA or BPRA website in case they do not already have one.

(b) Selecting the type of company to be registered

The applicant has an option to register either a foreign company; private company either limited by guarantee or shares, public company limited by shares or unlimited private company.

(c) Filling in the application form

The applicant will fill-in the application form as per details required. The details to be filled in the application form will depend on the type of company being registered.

(d) Uploading the attachments

The applicant will be obliged to upload the attachment. Some of the documents include; directors and shareholders details, certified copies of memorandum and articles of associations.

(e) Making and confirming payment

Once documents are successfully uploaded a control number for payment will be generated.

(f) Submitting the application

Once payment is received the applicant will submit the application.

(g) Decision from the agency

In case there are corrections in the submission, the applicant will get feedback on areas requiring modification. If there are no corrections, then the applicant will receive an approval and certificate of incorporation from the agency.

Procedures for Acquiring Business License from LGAs in Tanzania Mainland

The Local Government Authorities (LGAs) is entitled to offer a business license for class “B” businesses. Class “B” are such businesses that are established and operate in a specific local/district/municipal area. The following are the procedures for obtaining business license from LGAs in Tanzania Mainland:

(a) Opening an account

The applicant of a business entity will open an account on behalf of the entity. In opening an account, it is important for the applicant to have a national ID and TIN number.

(b) Selecting the type of business license being sought

As indicated earlier LGAs have several types of licenses they issue; therefore, the applicant has to select the type of business license.

(c) Filling the application form

Depending on the type of license the applicant will provide the necessary details required by the form. Details sought may include principal business details, and business contact information.

(d) Uploading the necessary details

The applicant is expected to upload the necessary attachments. These attachments may differ depending on the type of business being applied for.

(e) Decision from LGAs

Upon the applicant submitting the necessary details, the application may be rejected or approved.

(f) Making payment

If there is no objection a control number will be issued for payment. The amount to be paid will depend on the type of business.

(g) Receiving the license

Once the payment is made, the applicant receives a business license to start the business.

(h) Renewing the license

The applicant has an option to renew the license if it was for one (1) year or temporary (one month), transfer the license (in case the business location has changed), or terminate the license.

Procedures for Acquiring a Business License from BRELA or BPRA

BRELA and BPRA are entitled to offer a business license for class A businesses. Class A are such businesses that are established and operate across the country as well as engage in the international businesses that is across the national borders. The following are the procedures of acquiring business license from either BRELA or BPRA:

(a) Creating an account through online registration system (ORS)

The applicant acting on behalf of the company seeking a business license creates an online account via BRELA or BPRA in case they do not have one already.

(b) Filling in the application form

The applicant will fill-in the application form as per details required. The details to be filled differ depending on the type of business.

(c) Uploading the attachment

The applicant will be obliged to upload the required attachments.

(d) Making and confirming payment

Once documents are successfully uploaded a control number for payment will be generated. This allows the applicant to effect payment.

(e) Submitting the application

Once payment is received the applicant will submit the application.

(f) Decision from the agency

In case there are corrections in the submission, the applicant will get feedback of areas requiring modification. If there are no issues to attend, the applicant will receive an approval and business license from the agency.

Procedures for Applying for a Tax Identification Number (TIN) Certificate

Tanzania Revenue Authority (TRA) and Zanzibar Revenue Authority (ZRA) have several services that can be accessed online through the taxpayer portal with little or no physical movement of an applicant. Such services include TIN application and filing tax returns.

For medium-sized businesses to have a TIN it is a pre-requisite that one of the directors applying on behalf must have an individual TIN. An individual TIN number may be applied for by a director who is either a resident or non-resident.

In application for a TIN certification for a medium-sized business the following procedures are followed:

(d) Upload/submit the necessary documents that include:

- Certified memorandum and articles of association;

- Introduction letter from Local Government Authorities (LGAs);

- Certificate of incorporation;

- Certified lease agreement or title deed; and

- Power of Attorney.

Procedures for Registering with Pension Funds

The registration procedures vary slightly for each fund but it is crucial to understand the eligibility requirements set by the pension funds. Such criteria may consider factors like the number of employees or the sector in which the business operates.

Once the eligibility criteria are clear, the next step is to gather the required documents such as registration documents, tax identification number, and employees’ details. Afterward, the business should contact the relevant authority of the pension fund to obtain guidance on the registration process.

Then, the business needs to complete the application forms accurately and submit them along with the supporting documents to the pension fund authority. Upon submission, the business must await approval from the pension fund authority.

Once approved, the business will receive confirmation from the authority, including details such as the registration number with the fund and instructions for making periodic contributions. From there, the business can start making contributions to the pension fund on behalf of its employees, ensuring regularity and adherence to the fund’s guidelines.

By following these steps thoroughly, a business can successfully register to a pension fund and fulfill its obligations towards providing social security for its employees.

Shortly, the following are the procedures of registering for pension funds:

(b) Attach the necessary documents that include:

- a copy of certificate of incorporation or registration;

- TIN certificate;

- Business license; and

- Certificate of business name.

Activity 3

Visit at least two registered medium-sized businesses in your locality and explore how they got registered, the challenges they encountered, and how they managed to overcome them.

Exercise 3

- Describe the procedures for acquiring a business license issued by BRELA and BPRA.

- What key steps is a medium-sized business supposed to follow to get a Tax Identification Number (TIN) Certificate?

Sanctions for Non-Compliance of Registered and Unregistered Medium-Sized Businesses

The first obligation of the business entity including a medium-sized business is to register the business and acquire the necessary licenses before commencement. Failure to acquire the necessary licenses results in different sanctions for non-compliance. These sanctions differ depending on the type of license.

It should also be noted that sanctions are not only applied to unregistered businesses but also the registered ones depending on the fault committed. This section presents the sanctions for non-compliance of registered and unregistered medium-sized businesses.

Failure to operate the businessMost of the Acts establishing various licenses have clearly stated that a business entity that has not complied with the regulations should not start the respective business. A medium-sized business in particular is not expected to operate in Tanzania without having a valid business license. Therefore, any business without a valid business license is not expected to start or run a business in Tanzania.

Fines or penaltiesThe majority of the Acts and regulations have clearly stated that there will be fines or penalties in case a business entity fails to acquire the necessary licenses and permits. For example, in Tanzania Mainland, failure to comply with the Business registration procedures, may result in a respective business entity is facing a fine depending on the offense(s) committed.

ImprisonmentSome of the sanctions stated in some Acts and regulations have suggested imprisonment due to non-compliance. For instance, failure to meet the regulatory requirements of the business registration Act attracts a fine or imprisonment for a certain period.

Suspension or revocation or de-registration of the licenseSome licenses such as business license may be suspended, revoked, de-registered, or cancelled if the following happens:

- Premises have ceased to be used for the purpose for which the certificate of registration was issued;

- The business owner, manager or person-in-charge has, since the certificate of registration was issued, been convicted of any offence;

- The business owner has become bankrupt or if a company has gone into liquidation;

- Failure to comply with any condition of the certificate of registration;

- Submitted false information during the application; and

- Not complying with the laws governing the business.

Fines or penalties after registrationThere are some situations in which fines or penalties are instituted even after business registration.

These situations include the following:

- Changing location without notification to the issuing authority;

- Failure to file tax returns to the relevant authority;

- Carrying on business at any place not specified in the certificate of registration; and

- Failure to surrender certificate of registration which has been suspended, revoked or cancelled to Registrar.

Confiscation of propertyIn some other instances a medium-sized business is likely to have property confiscated in if the following happens:

- Tax evasion;

- Trading of counterfeit or expired products; and

- Trading in illegal or unregistered products.

Exercise 4

- Describe the types of sanctions that a medium-sized business is likely to face when operating an unregistered business.

- Discuss the scenarios in which a business license of a medium-sized business may be revoked or cancelled or de-registered or suspended.

- Explain the situations in which the property of a medium-sized business may be confiscated.

Skills Lab Activity

Discuss the different business opportunities available in the school environment and how they can be utilised.

Project Work

Based on what you have discussed in the skill lab, document the registration procedures of any business of your choice in relation to the identified business opportunities in the school environment and predict the challenges likely to be encountered during the process.

Chapter Summary

- Business registration is the process of obtaining legal authorisation to start and operate a business in a given locality.

- The importance of registering a business includes freedom to do business, access to credit, market access, intellectual property rights, improve tax administration and planning process.

- There are several types of licenses such as business license, business name registration certificate, company registration certificate, certificate of compliance, tax identification number certificate, and other sectoral licenses.

- There are several procedures for registering a business name, company, acquiring a business license, and tax identification number.

- Failure to register a business may lead to fines, penalties, imprisonment, business closure, suspension of the license, and confiscation of property.

Revision Exercise

- Describe the scope of business registration of a medium-sized enterprise.

- Registering a medium-sized business has been considered by most applicants as time-consuming, bureaucratic, and costly with little value. Debunk this myth by examining the importance of business registration accruing to the applicant and the public in general.

- Registering a medium-sized business is a very complex phenomenon as there are many licenses. Describe the generic licenses or permits or certificates that apply in Tanzania Mainland and Zanzibar.

- Critically illustrate at least five sectoral licenses you are aware of.

- Mr. and Mrs. Kasa plan to establish a private company limited by shares to sell pesticides. The company is expected to be located in Dar es Salaam region. Describe licenses that they are supposed to acquire before the commencement of the business.

- What are the important documents needed in acquiring a business license from either BRELA or BPRA?

- Ms. Khadija Swalehe is establishing a business in Babati, Manyara region. Describe the procedures that she must follow in registering the following:

- Business Name

- Company Registration

- Tax Identification Number

- With relevant examples from Tanzania, illustrate the types of sanctions that a medium-sized business is likely to face by not being registered.

- What can cause a medium-sized business to face fines or penalties after registration?

Leave a Reply