Chapter Four: Business Regulatory Environment in Tanzania – Business Studies Form Five

Introduction

Medium-sized businesses play a crucial role in driving economic growth. In so doing, they navigate a multifaceted regulatory landscape comprising various financial, legal, and operational requirements. Indeed, for a medium-sized business to achieve sustainable growth, it is critical to ensure compliance with policies and regulations.

In this chapter, you will learn about the roles of government and non-government agencies, as well as the policies and regulations that apply in promoting and controlling medium-sized business activities. The competences developed will orient you to comply with policies and regulations governing and supporting the establishment and operation of medium-sized businesses in Tanzania.

Roles of Government and Non-Government Agencies in Regulating and Supporting Businesses in Tanzania

Government and non-government agencies play complementary roles in regulating and supporting medium-sized businesses in Tanzania. This is done through the provision of essential services such as information, and financial assistance.

By so doing, they enable creation of environment that is conducive for medium-sized businesses and hence, contribute to the country’s economic development. In this chapter some of government and non-government agencies regulating and supporting businesses in Tanzania are discussed.

Government Agencies

Government agencies ensure proper policies and regulations that are developed to impact or support the business performance due to their strategy. It is important for business stakeholders to have knowledge of the laws and regulations governing the business environment in Tanzania. Different types of laws and regulations that can affect business include labour and consumer protection, environmental protection, social and business legislation, and tax legislation.

Additionally, there are specific laws and regulations for specific sectors such as transport, food and beverage industries, agricultural sector. Some of the government agencies supporting and regulating businesses in Tanzania are:-

- Tanzania Investment Centre (TIC)

- Zanzibar Investment Promotion Authority (ZIPA)

- Tanzania Revenue Authority (TRA)

- Tanzania Trade Development Authority (TanTrade)

- Small Industries Development Organisation (SIDO)

- Micro, Small and Medium Industrial Development Agency (SMIDA), and

- Fair Competition Commission (FCC).

These agencies are described as follows:

Tanzania Investment Centre (TIC)

The Tanzania Investment Centre (TIC) was established in 1997 under the Tanzania Investment Act (1997), Cap 38, Revised Edition (R. E) 2022 as the primary agency responsible for promoting and facilitating investments in Tanzania. Its key activities are geared towards coordinating, promoting, and facilitating investment in Tanzania and advising the government on policy matters to create a competitive, attractive, and sustainable investment climate.

Its mandate includes attracting domestic and foreign investors, facilitating business registration and licensing, and providing advisory services to investors. For medium-sized businesses, the Centre offers support in navigating the investment landscape, including assistance in obtaining investment certificates, permits, and licenses. In addition, TIC plays a significant role in creating an enabling environment for medium-sized businesses to succeed by providing information on investment opportunities in the country, incentives, and regulations.

Zanzibar Investment Promotion Authority (ZIPA)

Zanzibar Investment Promotion Authority (ZIPA) was established in 1986. It was initially a department under the Ministry of Finance and Economic Affairs of Zanzibar. ZIPA officially became an Authority under Act No. 4 of 2018. It is responsible for promoting and facilitating investments in Zanzibar.

The authority is also mandated to ensure a conducive business environment, processing approval for new investments, facilitation of incentives, and all necessary permits to investors. Further, ZIPA provides institutional support for economic development and ensures coherent economic and business policy formulation in Zanzibar.

The Tanzania Revenue Authority (TRA)

The Tanzania Revenue Authority (TRA) was established by Act of Parliament No. 11 of 1995, and started its operations on 1st July 1996. In carrying out its statutory functions, TRA is regulated by law, and is responsible for overseeing tax administration and revenue collection in Tanzania. Medium-sized businesses are subject to various tax obligations, including corporate tax, Value-Added Tax (VAT), and payroll taxes.

TRA plays a vital role in ensuring compliance with tax laws and regulations, providing guidance and assistance to medium-sized businesses in fulfilling their tax obligations. In keeping up with technological advancements, TRA offers online platforms and services for tax registration, filing, and payment, streamlining tax processes, and enhancing compliance among medium-sized businesses.

In Zanzibar, the Zanzibar Revenue Authority (ZRA) works hand in hand with TRA to enhance tax administration. Tax compliance by medium-sized enterprises allows the government to carry out its functions like provision of education, health and infrastructure development effectively. This in turn helps to mitigate medium-sized business challenges hence improving their performance.

Tanzania Trade Development Authority (TanTrade)

Tanzania Trade Development Authority (TanTrade) was established by the Tanzania Trade Development Authority Act No. 4 of 2009. TanTrade replaced the Board of External Trade (BET) which was established by Act No. 5 of 1978 and the Board of Internal Trade (BIT) Act No. 15 of 1973. In facilitating trade, TanTrade works to create a conducive environment for medium-sized businesses to operate and thrive.

Through its efforts to enhance the performance of the trade sector, TanTrade indirectly supports medium-sized businesses by facilitating access to markets, promoting export opportunities, and providing regulatory guidance. Additionally, TanTrade’s initiatives to organise international trade fairs create platforms for medium-sized businesses to showcase their products, expand their networks, and explore new business opportunities both domestically and internationally.

Small Industries Development Organisation (SIDO)

Small Industries Development Organisation (SIDO) was established under the Act No. 28 of 1973. Since its establishment in October 1973 under the then Ministry of Trade, Industry, and Marketing, SIDO has played a significant role in nurturing medium-sized businesses in Tanzania. Originally tasked with developing the small industry sector, SIDO has also evolved to provide comprehensive support to medium-sized enterprise development by providing access to infrastructure, technology, and skills development.

Moreover, SIDO collaborates closely with other government agencies and international donors, including Tanzania Bureau of Standards (TBS), Swedish International Development Cooperation Agency (SIDA), and the World Bank (WB) to implement programs aimed at supporting businesses in Tanzania.

These initiatives encompass technology development and transfer which has significantly contributed to the growth and competitiveness of medium-sized enterprises in Tanzania. Generally, SIDO capitalizes on strategic interventions and partnerships to remain a key catalyst for the development of businesses in Tanzania, and fostering economic growth in the country.

Micro, Small, and Medium Industrial Development Agency (SMIDA)

The Micro, Small, and Medium Industrial Development Agency (SMIDA) was established by Act No. 2 of 2018 as an industrial development agency under the Ministry of Trade and Industries implementing almost the same activities as SIDO in Zanzibar. The core functions of the Agency are to advise, develop, coordinate, promote, and offer every form of support to micro, small, and medium-sized industries in Zanzibar.

Its support spans from the early stage of formalisation, marketing of the product to graduation of SMEs to large industry category. In addition, SMIDA facilitates affordable credit schemes and other financial and non-financial services through the Small and Medium Industrial Development Fund (SMIDE) in Zanzibar.

Fair Competition Commission (FCC)

The Fair Competition Commission (FCC) was established under Act No. 8 of 2003 with a crucial role in ensuring fair and competitive market practices in Tanzania. FCC is mandated to intervene in markets to prevent anti-competitive behaviour, market dominance, price fixing, and other practices that could harm businesses and disrupt market stability.

By curbing such practices, the FCC fosters an environment where medium-sized enterprises and other businesses can compete fairly in the market. Further, the FCC’s oversight extends to addressing abuse of domination and scrutinizing mergers and acquisitions that lead to market concentration which are detrimental to medium-sized businesses. Through these interventions, the FCC safeguards enterprises by ensuring they have equitable opportunities to grow and succeed in the marketplace.

The Roles of Government Agencies in Promoting Businesses

Government agencies in Tanzania execute various programs and initiatives aimed at promoting businesses including medium-sized enterprises through accessing finance, capacity building, and market development. By addressing key challenges related to access to finance, capacity building, and market development, the agencies contribute to creating a conducive environment for businesses including medium-sized enterprises. In turn, medium-sized businesses thrive, innovate, and contribute to the country’s economic development goals.

Some of the key roles of the government agencies in promoting businesses in Tanzania include the following:

1. Access to Finance

Government agencies such as the Tanzania Commercial Bank (TCB) and the Tanzania Agricultural Development Bank (TADB), provide financial support to medium-sized businesses through loans, grants, and subsidies. Similarly, specialized financing programs, such as the Medium and Small Enterprises Credit Guarantee Scheme, aim at mitigating the risks associated with lending to medium-sized businesses through encouraging financial institutions to extend credit to this sector. Furthermore, the government collaborates with international development partners and microfinance institutions to expand access to financial services for medium-sized businesses.

Government agencies such as SIDO and the Vocational Education and Training Authority (VETA), offer capacity-building programs tailored to the needs of different businesses including medium-sized enterprises. Such programs include technical skills development, entrepreneurship training, and managerial capacity enhancement. These programs equip medium-sized business owners and employees with the knowledge and skills needed to operate and grow their enterprises effectively.

Government agencies work to create an enabling environment for medium-sized businesses to access both domestic and international markets through trade facilitation measures and market development initiatives. Export promotion programs are performed by the Tanzania Trade Development Authority (TanTrade), which assists medium-sized businesses in exploring export opportunities, accessing trade information, and participating in trade fairs and exhibitions.

Moreover, the government invests in infrastructure development, logistics, and trade facilitation in terms of improvements to transportation networks, customs procedures, and trade corridors to enhance market access for medium-sized businesses.

Non-Government Agencies

Some of the non-government agencies supporting businesses in Tanzania are Tanzania Chamber of Commerce, Industry, and Agriculture (TCCIA), Zanzibar National Chamber of Commerce (ZNCC), Tanzania Association of Micro-Finance Institutions (TAMFI), and Tanzania Private Sector Foundation (TPSF). These agencies are described as follows:

Tanzania Chamber of Commerce, Industry, and Agriculture (TCCIA)

The Tanzania Chamber of Commerce, Industry, and Agriculture (TCCIA) serves as a crucial institution in supporting the growth and development of businesses including medium-sized enterprises in Tanzania. Since its establishment in 1988, TCCIA has played a vital role in facilitating the country’s transition from a centralized, planned economy to a more open, mixed economy that embraces private ownership and entrepreneurship. By collaborating closely with international organisations and the Tanzanian government, TCCIA works to support the private sector and create an enabling environment for medium-sized businesses to flourish.

Through its advocacy efforts, capacity-building initiatives, and networking opportunities, TCCIA empowers medium-sized businesses to navigate regulatory challenges, access market opportunities, and foster growth. Similarly, TCCIA helps in shaping policies and regulations that support the needs of medium-sized businesses by facilitating dialogue between the private sector and government. Furthermore, TCCIA enhances access to resources, expertise and market linkages for medium-sized businesses, initiatives which enable them to compete effectively in domestic and global markets.

Zanzibar National Chamber of Commerce (ZNCC)

The Zanzibar National Chamber of Commerce (ZNCC) was established in 2007 as the Zanzibar National Chamber of Commerce, Industry and Agriculture (ZNCCIA). Its name was shortened deliberately as a branding strategy to encompass all private sector players in Zanzibar. ZNCC is an apex body of the private sector in Zanzibar.

It acts as a voice of the private sector linking its members to the government. Its main functions are advocacy, training, networking, and information sharing. Other specific activities provided to its members include the facilitation of all matters concerning trade, market opportunities, business advisory services, and entrepreneurial skills development.

Tanzania Association of Micro-Finance Institutions (TAMFI)

Tanzania Association of Micro-Finance Institutions (TAMFI) is a not-for-profit umbrella organisation for microfinance institutions in Tanzania. It was formally registered in 2001 as the network for microfinance activities in the country. The association seeks to develop the capability of microfinance institutions and the microfinance sector in general through advocacy, lobbying, research and development, responsible microfinance, capacity building, and information gathering and dissemination.

The association promotes and encourages the establishment of new products and related markets, and organises forums and meetings in order to promote communication among members, to strengthen their relationship and to transfer information and experience among them. TAMFI encourages networking which is an integral part of any association.

Tanzania Private Sector Foundation (TPSF)

Tanzania Private Sector Foundation (TPSF) was formally incorporated under the Companies Act (Cap 212) as a company limited by guarantee on 4th November, 1998 for the purpose of promoting private sector-led social and economic development in Tanzania. As an apex and focal private sector organisation, the Tanzania Private Sector Foundation (TPSF) is the voice of the private sector and the umbrella body for private sector associations and corporate bodies in all sectors of the economy, including trade associations.

Its members are business associations, corporate companies, multinationals, SMEs, start-ups, and working groups of the various sectors of the economy. TPSF provides a platform for the private sector to engage in Public-Private Dialogue (PPD) at local, national, and international levels. The Foundation opens potential markets for its members through business forums and participation in local and international trade fairs, as well as offering programs to build the capacity of members to become competitive in both local and international markets.

The Roles of Non-Government Agencies in Promoting Businesses

Generally, the non-governmental agencies play the following roles in promoting medium-sized businesses in Tanzania:

Non-government agencies in collaboration with the private sector engage with the government in case of issues pertaining to the business environment. Specifically, they advocate for public-private dialogue, policy advocacy and facilitate reforms in the business environment at local and national levels. At times these non-government agencies involve higher learning institutions to undertake policy research to properly engage the government in case there is an issue that requires evidence-based analysis.

Non-government agencies offer customized training to the private sector community as part of building capacity in terms of knowledge and skills. The training sessions are usually aimed at enhancing business management, market access, financial management and technology efficiency.

Non-government agencies provide platforms and avenues for the private sector to network or engage with various stakeholders in the business ecosystem. These stakeholders include suppliers, agents, distributors, policy makers, financiers or investors, development partners, and customers. Such networking platforms are very pertinent to business sustainability.

Non-government agencies have different programs that enhance market access. These programs include the provision of market information, linkages to various markets, and preparation of exhibitions both locally and internationally. Through such forums, the business community can showcase their products to their potential customers. In turn this stimulates more sales.

Activity 1

(a) With the help of ICT collect information on three (3) government and two (2) non-government agencies responsible for regulating and supporting medium-sized businesses in Tanzania.

(b) For each agency in part (a), gather information about its mandate, functions, and recent activities relating to supporting businesses in Tanzania.

(c) Pay a visit to any of the agencies in part (b), interact with the staff, and observe their operations.

(d) Describe the roles played by the agencies visited in supporting medium-sized businesses in Tanzania.

Exercise 1

- What is the primary objective of the Tanzania Trade Development Authority (TanTrade), and how does it contribute to the development of medium-sized businesses in Tanzania?

- Explain the overarching challenges and opportunities that medium-sized businesses face in Tanzania when conducting their activities.

- Imagine you are managing a tech company encountering obstacles of regulatory compliance and access to funding. Which government agencies can help you in addressing the problems of regulatory compliance and access to funds?

Policies Promoting Businesses in Tanzania

Policies are guidelines, regulations, and measures established by governments or organisations to guide decision-making to achieve specific objectives in various sectors. In the context of promoting business enterprises, policies are developed to create an enabling environment to facilitate the growth and sustainability of businesses.

This is because policies can unlock the full potential of entrepreneurship and enterprise development by aligning regulatory frameworks, incentives, and support programs with the needs and aspirations of businesses.

The Importance of Policies in Promoting Business Enterprises

The following are the importance of policies in promoting business enterprises:

Policies provide a framework of rules and regulations that support business activities by protecting property rights, ensuring legal certainty, and promoting fair competition. To foster a conducive business environment for enterprises to thrive, policies encourage investment, entrepreneurship, and innovation by establishing a transparent and predictable operating environment.

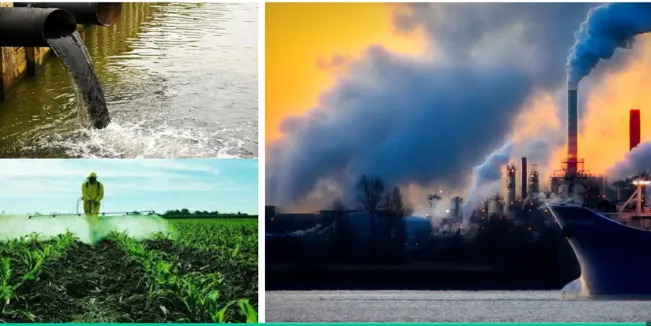

Policies address market failures and distortions that hinder efficient allocation of resources and business development. Policies may target externalities such as information asymmetry, pollution, or monopolistic practices to promote market efficiency and competition which will eventually ensure a level playing field for businesses of all sizes.

Policies aim to improve access to crucial resources that are essential for business growth and competitiveness. Such resources include finance, technology, infrastructure, and labour. Through targeted interventions, policies support business enterprises in overcoming barriers to entry and expansion, enabling them to access the needed resources to innovate, invest, and create value.

Policies promote business enterprises by encouraging investment, job creation, and productivity improvements. By fostering entrepreneurship and supporting the growth of Small and Medium Enterprise (SMEs), policies contribute to poverty reduction, income generation, and inclusive economic development, thereby improving living standards and enhancing social welfare.

Policies promote responsible business practices by establishing regulations, standards, and incentives to address social and environmental challenges. Through measures such as environmental regulations, Corporate Social Responsibility (CSR) initiatives, and labour standards, policies encourage businesses to operate sustainably, ethically, and in harmony with communities, thereby fostering long-term societal well-being and value creation. In several cases, socially responsible enterprises tend to outperform those that are not.

Policies Promoting Medium-Sized Businesses

Policies play a crucial role in fostering economic growth, innovation, and consequently job creation in Tanzania. By creating an enabling environment for medium-sized businesses to thrive, these policies stimulate investment, enhance productivity, and promote sustainable development across various sectors. There are several policies, laws, and bylaws promoting medium-sized businesses, however, in this chapter investment and industrial policies are discussed.

I. Investment Policies

The investment policies and incentives available to medium-sized businesses in Tanzania are designed to stimulate economic growth, attract domestic and foreign investments, and create employment opportunities. In Tanzania, several national investment strategies, policies, and programs have stipulated some interventions with important implications on medium-sized enterprises growth and sustainability as exhibited in some of the following policies and strategies:

Tanzania Development Vision 2025 (TDV 2025) was developed in the late 1990s to guide economic and social development efforts up to the year 2025 with the aim of transforming Tanzania into a middle-income country and transforming the economy from a predominantly agricultural one to a diversified and semi-industrialized economy with a substantial industrial sector comparable to typical middle-income countries.

Among the investment priorities that aim to steer Tanzania to achieve middle-income status by 2025, the vision strategizes on how to support medium-sized businesses to implement light manufacturing activities. The targeted industries are agro-processing, manufacturing of consumer durables, and assembly industries (processing of meat, leather, fruits, nuts, wood, and paper production).

Through the vision, the government of Tanzania anticipates to attract private sector investments which are vital to the future growth and productivity of the economy. Thus, the vision details how the government undertakes to alleviate constraints to private sector participation in the desired industrialization and socio-economic transformation. These activities include providing appropriate guidance to the private sector and all other stakeholders, investing in ways that leverage the participation of the private sector, making limited smart interventions, as necessary in areas that are important for Tanzania’s development and nurturing collaborative action, and effective state-business relations.

The National Investment Promotion Policy of 1997 was established with the objectives of supporting maximum mobilization and utilization of domestic capacity including cooperation with other countries, promotion of export orientation on domestic production of goods and services to enhance the development of the export sector, encouragement of inflows of external resources to complement national efforts, encouragement and facilitation of the adoption of new technologies, and enhancement of transparent legal framework that facilitates the promotion and gives due guarantee of protection to all forms of investment activities.

These overarching policies give rise to numerous other regulations and strategies for promotion of investment in Tanzania. The following are key areas covered in the various policy and strategies for promotion of investment in Tanzania:

A tax incentive is an aspect of government policy that lowers the amount of tax that individuals or businesses owe in order to encourage certain activities or achieve specific goals. The government of Tanzania offers various tax incentives to medium-sized businesses to encourage investment and stimulate economic growth. These incentives include tax holidays, reduced corporation tax, and exemptions from income tax, export and import duties, and Value-Added Tax (VAT) on certain products.

Several laws and regulations provide room for tax incentives such as the Zanzibar Investment Promotion and Protection Act No. 14 of 2018, the Value Added Tax Act Cap 148 revised edition of 2019, the Income Tax Act Cap 332 revised edition of 2019, and the East African Community (EAC) Customs Management Act of 2004 and its amendments. By reducing the tax burden on medium-sized enterprises, these incentives aim to enhance their competitiveness, attract investment, and facilitate business expansion.

An investment guarantee is a form of financial protection that is offered by governments to investors to safeguard them against potential losses. The Tanzanian government provides investment guarantees to medium-sized businesses to mitigate risks and instill confidence in investors. These guarantees may take the form of guarantees against nationalization, and breach of contract, as well as guarantees for repatriation of profits and capital.

By offering assurances of protection and stability, investment guarantees help to attract long-term investment and foster a conducive business environment for medium-sized businesses. For a medium-sized business to enjoy the investment guarantee, it has to register with TIC and enjoy the rights as provided in the Tanzania Investment Act No. 10 of 2022.

These rights include investment guarantees, access to land, and employing expatriates. In addition, investments are guaranteed against any form of expropriation. Tanzania is a signatory of several multilateral and bilateral agreements on the protection and promotion of foreign investment.

The government of Tanzania prioritizes domestic investment and offers preferential treatment to domestic investors including medium-sized businesses, through various policies and initiatives. Domestic investors benefit from preferential access to government procurement contracts, priority in obtaining licenses and permits, and eligibility for government-funded development programs and incentives.

Moreover, the government may provide financial support, technical assistance, and capacity-building programs specifically tailored to the needs of domestic investors thereby promoting the growth and competitiveness of medium-sized businesses operating in Tanzania.

In addition, domestic investors have access to the following international preferential treatments:

1. The African Caribbean and Pacific-European Union (ACP-EU) framework signed on 15th November 2023 with the aim of mobilising investment, supporting trade and fostering private-sector development, to achieve sustainable and inclusive growth and create decent jobs for all.

2. The African Growth Opportunity Act (AGOA) was enacted on 18th May 2000 as Public Law 106 of the 200th Congress of the United States of America (USA). The AGOA legislation has been renewed on different occasions, most recently in 2015, when its validity was extended to September 2025.

It provides duty-free entry into the United States for almost all African products, which helps in fostering an improved business environment in Tanzania. Tanzania also qualifies for textile and garment benefits under the AGOA.

3. The East African Community (EAC) vision 2050 signed on 2nd March 2016 as implementation of the EAC treaty of 1999 aimed at promoting inter and intra-regional trade and investment through creating a conducive environment for cross border and foreign investment. In the Vision, Tanzania’s priority areas include promotion of an investment and savings culture.

The vision is currently in the early stages of phase 2 out of 7 phases with activities that include strengthening human capital and conducting feasibility studies on the investment infrastructure. The EAC also signed a Trade and Investment Framework Agreement (TIFA) with the USA in 2008 which is in force to date.

Activity 2

Conduct a library search and describe the specific tax incentives provided under various investment policies in Tanzania.

Industrial Policies

Industrial policies are strategic initiatives designed by the government to facilitate the development and expansion of key sectors and industries within an economy. These policies aim at creating a favourable environment for businesses to thrive. Industrial policies encompass several measures tailored to specific sectors including fiscal incentives, infrastructure development, research and development support, and regulatory reforms.

In the context of medium-sized businesses, industrial policies are particularly relevant as they provide frameworks and support mechanisms to overcome challenges and capitalize on opportunities within their respective sectors. Industrial policies include initiatives geared to streamline regulatory processes, reduce administrative burdens, and enhance access to finance and market opportunities. Effective industrial policies play a crucial role in promoting the growth and competitiveness of medium-sized businesses thereby contributing to economic development and prosperity.

In Tanzania, several national industrial strategies, policies and programs have stipulated some interventions with important implications on medium-sized enterprises growth and sustainability as exhibited in some of the following policies and strategies:

The policy aims at stimulating SMEs development and growth through improved legal and institutional framework, enhancement of services provision, and improvement of infrastructures. Generally, this policy intends to create an enabling environment for businesses to prosper in the country including the medium-sized enterprises.

The policy aims at transforming Tanzania’s economy by enhancing the competitiveness of the domestic producers to participate in the global economy through trade liberalization. The trade policy focuses on increasing efficiency and linkages in domestic production to achieve a diversified competitive export sector, which in turn stimulates growth and development in the country.

The policy emphasised on the promotion of small and medium-sized industries. To achieve this, the SIDP focused on simplification of business registration and licensing processes. Again, SIDP encouraged the simplification of taxation as well as the formalization of the informal businesses in the country. Further, SIDP focused on the improvement of financial services accessibility, including enabling youth, women, and people with disabilities to be involved in economic activities.

The strategy is like an update of the SIDP as it focuses on ensuring that the objectives of SIDP are implemented. Thus, IIDS emphasises on transformation in the agriculture sector by improving productivity from low to semi-industrialized, with the private sector being considered as the vehicle for economic development.

The policy aims at addressing the obstacles and problems in the development of the value chains in the agricultural sector in the country. Such problems addressed by NAP in the agriculture value chains include poor quality of the agricultural products, limited participation of the private sector, insufficient productivity, insufficient support services, over-dependency of the sector on rain for agricultural activities, poor infrastructure and facilities. NAP also addresses other factors affecting agricultural value chains like environmental deterioration, crop pests and diseases.

The Blueprint was established to provide an enabling business environment to improve business operations in the country. This reform emphasizes that government agencies should provide relevant information to the private sector and the private sector should be prioritized in the envisaged reforms because of their role in economic transformation in Tanzania.

Task 1

Review at least two industrial policies in Tanzania:

(a) Describe their objectives and key provisions; and

(b) Explain how each policy promotes medium-sized businesses growth.

Exercise 2

- Suppose you own a medium-sized business, discuss the importance of skills training and workforce development initiatives in enhancing the competitiveness of your enterprise.

- Assume you are operating a medium-sized business in Tanzania. Explain how your business operations may be impacted by the policy with examples of specific industrial policies.

Chapter Summary

- Government and non-government agencies regulate and support medium-sized businesses in Tanzania.

- The Tanzania Investment Centre (TIC) is primarily responsible for promoting and facilitating investment in Tanzania. Its key activities are geared to coordinate, promote, and facilitate investments in Tanzania.

- Zanzibar Investment Promotion Authority (ZIPA) ensures a conducive business environment, processes approval for new investments, and facilitates incentives and all necessary permits to investors in Zanzibar.

- The Tanzania Revenue Authority (TRA) is responsible for overseeing tax administration and revenue collection in Tanzania.

- TRA offers online platforms and services for tax registration, filing, and payment, streamlining tax processes and enhancing compliance among medium-sized businesses.

- Tanzania Trade Development Authority (TanTrade) supports medium-sized businesses by facilitating access to markets, promoting export opportunities, and providing regulatory guidance.

- The key roles of Micro, Small and Medium Industrial Development Agency (SMIDA) are to advise, develop, coordinate, promote and offer every form of support to micro, small and medium industries in Zanzibar.

- The Fair Competition Commission (FCC) is mandated to intervene in markets to prevent anti-competitive behaviour, market dominance, price fixing, and other practices that could harm consumers and disrupt market stability.

- The Tanzania Chamber of Commerce, Industry and Agriculture (TCCIA) works to support the private sector and create an enabling environment for medium-sized businesses to flourish.

- Zanzibar National Chamber of Commerce (ZNCC) is an apex body of the private sector in Zanzibar with the main functions of advocacy, training, networking, and information sharing.

- Tanzania Association of Micro Finance Institutions (TAMFI) seeks to develop capability of micro-finance institutions and the micro-finance sector in general through advocacy, lobbying, research and development, responsible micro finance, capacity building, information gathering and dissemination.

- The Tanzania Private Sector Foundation (TPSF) is the voice of the private sector and the umbrella body for private sector associations and corporate bodies in all sectors of the economy, including trade associations in Tanzania.

- Policies are guidelines, regulations, and measures established by governments or organisations to guide decision-making and achieve specific objectives in various sectors.

- Policies play a significant role in promoting business enterprises by creating an enabling environment, addressing market failures, facilitating access to resources, stimulating economic growth and development, and ensuring social and environmental responsibility.

- Some of the policies which promote medium-sized businesses include investment policies and industrial policies. These policies encompass a range of measures, including tax incentives, investment guarantees, and preferential treatment for investors.

Revision Exercise

- Analyse the role of government agencies as stakeholders in regulating businesses in Tanzania.

- Suppose you are a medium-sized business owner in Tanzania, how can you benefit from the services provided by the Tanzania Investment Centre (TIC)?

- What tax obligations are medium-sized businesses subject to in Tanzania and how does the Tanzania Revenue Authority (TRA) or Zanzibar Revenue Authority (ZRA) assist in fulfilling those obligations?

- In which ways does the Tanzania Trade Development Authority (TanTrade) support medium-sized businesses in accessing markets and export opportunities?

- How can one leverage the support provided by the Small Industries Development Organisation (SIDO) to enhance the enterprise’s growth and competitiveness?

- Discuss the role of the Small Industries Development Organisation (SIDO) in fostering innovation and technology transfer among medium-sized businesses.

- Discuss the role played by the Fair Competition Commission (FCC) in ensuring fair and competitive market practices for medium-sized businesses in Tanzania.

- Suppose you are a medium-sized business owner, how can you engage with the Fair Competition Commission (FCC) to address market challenges and ensure fair competition?

- Explain how medium-sized businesses benefit from the investment policies and incentives offered by the Tanzanian government.

- What key challenges do medium-sized businesses face in accessing finance and how do government agencies address these challenges?

- Describe the capacity-building programs available for medium-sized businesses in Tanzania and show how they can enhance enterprises development.

- How do government agencies collaborate with international partners to support medium-sized businesses in Tanzania?

- What are the roles played by the Tanzania Chamber of Commerce, Industry and Agriculture (TCCIA) in supporting medium-sized businesses?

- How does the Tanzania Revenue Authority (TRA) ensure that medium-sized businesses comply with tax laws and regulations.

- What incentives does the Tanzanian government offer to encourage medium-sized businesses to invest in key sectors?

- Outline multilateral and bilateral agreements for international preferential investment that Tanzania has adopted.

Leave a Reply