Topic 1: Introduction to Book-Keeping – Book Keeping Notes Form One New Syllabus

Main competence:

To enable students to appreciate the importance of keeping business financial transactions and have ability to negotiate and reason effectively during business deals.

CONCEPT OF BOOK-KEEPING

- Even business operators or owners without a proper knowledge of Book keeping will somehow unknowingly apply Book keeping principles in order to achieve various objectives of their businesses.

Origin Of Book-Keeping:

- The origin of Book-keeping can be traced back to the ancient civilians like Sumeria and Egypt.

- These societies developed systems to record and track transactions and goods exchanged.

- Overtime, Book-keeping principles advanced to various techniques through contributions from Greeks and Romans entrepreneurs.

- In the medieval period, Luca Pacioli in 1494 played a significant role in promoting double entry Book- keeping system.

- This introduction was a significant development that revolutionized the field of Book- keeping has continued to evolve, adapting to changing economic systems and technological advancements.

- As we speak, Book-keeping remains a vital part of accounting and financial management, ensuring maintenance of records, facilitating financial reporting, analysis, and maintaining transparency and accountability in financial affairs.

Meaning Of Book-Keeping

Book keeping can be defined as the art of recording business financial transactions in the books of accounts in an orderly manner.

Book keeping is the process of recording data relating to accounting transactions in the accounting books.

Book-keeping is the systematic recording, organizing and tracking of financial transactions and activities within a business.

Book keeping is the technique of recording financial transactions as they occur so that summaries may be made of the transactions and presented as a report to the users of accounting information.

book-keeping is a branch of accounting which deals with recording financial data of business transactions or events.

The person who keeps the records of business is known as Book keeper.

Scope Of Book-Keeping

The process of Book-keeping covers the recording, classification, organization and maintenance of records of financial transactions.

It plays central role in providing accurate financial information for decision making, legal and regulatory compliance and financial analysis within a business.

PURPOSE OF BOOK-KEEPING

The specific purposes of Book-keeping include;

Financial records

It provides a comprehensive record of financial transactions, which helps in maintaining a clear and accurate account of the enterprise’s financial activities.

Compliance and legal requirements

Organized and appropriate financial records are necessary for preparing tax returns and, meeting financial reporting requirements.

Financial management

By having up-to-date financial records, an enterprise can make informed decisions regarding investment, budgeting and resource allocation.

Facilitating business decision making

Management with accurate financial data can analyze different aspects of the business, identify areas for improvement, and make strategic decisions to drive business growth.

THE IMPORTANCE OF BOOK-KEEPING

Book keeping is important to business owners and other parties outside of an enterprise for the following reasons:

Determination of the amount of profit or loss

If the business man/woman keeps records by all means he/ she should know whether they run business into profit or losses through the preparation of Income statement.

Knowledge of credit dealings/ Knowledge of credit transactions

book keeping helps enterprises to maintain appropriate records of their credit transactions and know the amount due from each of its debtors and the amount owing to each of its creditors since such records can systematically be kept following Book- keeping principles.

Business control/ control of business

A business man / woman can be able to control his /her business as required by the principle, because he /she would be able to follow the proper records. also help the proprietor to detect errors, frauds, and any misappropriation of funds.

Fair tax assessment

Tax authorities such as Tanzania Revenue Authority (TRA) requires the proper keeping of financial records helps both the owner and the tax authorities to assess the amount of tax payable fairly.

Reliable financial position of the business

in order to know the value of property and the amount of capital and liability, the business man/woman need to keep the record of book keeping, the owned and their capital increase or decrease.

ACCOUNTING PROCESS/ACCOUNTING CYCLE

Meaning of Accounting Cycle:

The accounting cycle is the systematic process of identifying, recording, processing, and summarizing financial transactions of a business during a specific.

It ensures that a company’s financial statements are accurate and comply with accounting standards.

The six basic stages in the accounting cycle/ accounting process are summarized as follows:

Stages of the Accounting Cycle:

Identifying transactions and recording in source documents:

This is the first stage in the accounting process where financial transactions are identified and evidenced through source documents such as receipts, payment vouchers, invoices, cheques, debit note, and credit note.

Recording the transactions in the books of prime entry:

The transaction is initially recorded in these books before it is recorded or posted anywhere else. This book will focus on six types of books of prime entry, namely a sales journal, a purchases journal, a sales returns journal, a purchase returns journal, a general journal, and a cash book.

Posting transactions to the ledger accounts

This process involves the posting of entries that were initially recorded in the books of prime entry to the ledger accounts. The posting of entries to the respective ledger accounts is done by following the double entry system of Book-keeping.

Extracting the trial balance

The trial balance is a list prepared at a specific date showing net figures or balances of all general ledger accounts. The account balances extracted from the general ledger are listed in the debit and credit columns of the trial balance.

Making adjusting entries and correction of errors

A trial balance is expected to reveal some errors which may have been made when transactions are first entered in the books of prime entry or when double entry is done in the ledger. This is a process that goes together with making any necessary adjustments of the balances before the preparation of financial statements.

Preparing the financial statements

The aim of preparing the financial statements is to know the performance, financial position, and cash flows of the enterprise.

TYPES OF BOOK-KEEPING METHODS/SYSTEMS

The following are the two systems of Book-keeping:

Double-entry Book-keeping Double-entry:

It follows the principle that every transaction has equal and opposite effects on at least two accounts.

Each transaction is recorded with a debit entry in one account and an equal credit entry in another.

This method maintains a system of accounts, including assets, liabilities, equity, revenue, and expenses. Double-entry book-keeping ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced.

Single-entry Book-keeping:

In this method, only a single entry is made for each transaction, typically in a revenue or expense journal or a cash book. It records income and expenses, but it does not track individual accounts for assets and liabilities.

While single-entry book-keeping is suitable for small businesses with straightforward transactions, double-entry book-keeping is the standard method used by most businesses due to its accuracy, reliability, and ability to provide a comprehensive financial overview.

Introduction to Book-Keeping

Common terms used in Book-keeping

The following are some basic terms used in book-keeping;

- Drawings

is the amount of money or goods taken from the business for personal uses.

- Assets

are resources controlled by a business owner that have economic benefits to the business. include cash, inventory, equipment, and property.

- Liabilities

Are Debts or obligations of a business to external parties, such as loans, trade and other payables, and accrued expenses.

- Expenses

Are Costs incurred by a business in the process of generating revenue, including salaries, rent, utility bills and other operating expenses.

- Debit entry

An entry that results in an increase in assets or expenses or a decrease in liabilities.

- Credit entry

An entry that results in an increase in liabilities, or revenue or a decrease in assets or expenses.

- Double-entry

Is a system of book-keeping that records each financial transaction with equal and opposite entries on two different accounts.

- Ledger

is a main book or digital record in which financial transactions are recorded.

- Journal

is the book or electronic record where financial transactions are recorded for the first time.

- Debtor

This term refers to a customer who buys goods or services from business on credit. debtor is a person who owes money to the business. He or she has an obligation to the business. Another name for this account is accounts receivable.

- Creditor

This term refers to a person who sells goods or renders services on credit to the business. Therefore, a creditor is a person to whom the enterprise owes money. Another name for creditors is accounts payable.

- Trade receivables

This refers to money owed to a business by its customers for goods sold on credit.

- General ledger

This refers to the central repository of all financial transactions recorded by a business. It is categorized by account such as assets, liabilities, revenue, and expenses.

- Trial balance

It is a statement that show the list of all general ledger accounts with their respective debit and credit balances.

- Revenue

refers to income generated by a business from its primary operations such as sales of goods or services.

- Depreciation

This refers to the reduction in the value of a long-term asset over its useful life. This refers to the systematic allocation of the cost of a long-term asset over its useful life to match such cost with the revenue generated by the asset over its life.

- Cash flow

This refers to the movement of cash into and out of a business over a specific period.

- Business

This refers to any legal activity undertaken with the aim of making profits. Examples of business include farming, a restaurant, a salon, and a kiosk.

- Capital

It is the amount of money or money’s worth provided by the owner to start an enterprise or to expand it.

- A sole proprietor

is the owner of the enterprise who provides capital to start or expand the enterprise alone.

- Goods

These are items bought and sold by the proprietor and they have the characteristics of being seen and touched. Goods are sold by business people to satisfy the needs of customers. Examples of goods include pens and exercise books for a stationery business, food for a restaurant business, and cement for a hardware business.

- Services

These are activities performed by the enterprise in the course of business that does not involve itself in selling physical goods. Examples of services offered by different enterprises are hairdressing, drama shows, advertising, and training.

- Profit

is the excess of revenues over expenses for a particular period or activity.

- Loss

is the excess expenses over revenues for a particular period or activity.

- Transaction

refers to the movement of money or money’s worth between two or more parties. For example, Juma paid Paula TZS 20,000 to buy a pair of shoes.

- Cash transaction

is the transaction occurring when cash is paid immediately after receiving goods or services.

- Credit transaction

is the transaction occurring when cash is paid later after receiving goods or services.

- Bank overdraft

is the situation where by customer allowed to withdrawal more money than what he/she has in the bank account.

- Bad debt

is the amount of money that customer failed to pay the business.

- FASB (financial Accounting, Standards Board)

is the organization responsible for setting accounting standards in the United States.

RELATIONSHIP BETWEEN BOOK-KEEPING AND OTHER DISCIPLINES

The knowledge and skills acquired in Book-keeping are also applicable in different subject areas covered in the Ordinary Secondary Education Curriculum and beyond.

The relationship that exists between Book-keeping and some other disciplines is explained as follows:

- Accountancy

Book-keeping lays down the foundation of the Accountancy subject. It deals with recording and posting entries to various ledgers that are used by accountants to analyze, interpret and make informed decisions about the business.

Accountants produce reports popularly known as financial statements. Therefore, without the knowledge of Book-keeping, it would be difficult for accountants to prepare and analyze financial statements.

The following are the differences between Book-keeping and Accounting

S/N |

BOOK-KEEPING |

ACCOUNTING |

| i. | It is concerned with the recording of business financial transactions in the books of accounts | It is more extensive since it deals with classification, summarization, and interpretation of financial statements |

| ii | It is based on accounting policies and systems already laid down | It lays down policies and systems for use in Book keeping |

| ii | It is done according to accounting standards and concepts | It is done according to accounting standards but techniques used for analyzing and interpreting financial statements vary from firm to firm |

| iv | Book keeping serves the purpose of having the transactions recorded in books and reflected in the financial statements | It ensures that the system is in place for having the Book-Keeping process undertaken, and spans further into making appropriate assumptions and estimates |

| v | It requires skills in double entry system of Book-Keeping | In addition to Book-Keeping skills, accounting requires analytical |

- Business studies

Business Studies provide a broader understanding of the overall business environment and operations, while Book-keeping is a systematic recording of financial transactions gained from business activities.

Book-keeping develops skills for maintaining economics records, calculating national income, performing cost analysis and production costs.

- Home Economics

Book-keeping supports Home Economics by providing a system to financial record- keeping, budgeting, expenses tracking, financial planning, tax preparation and decision-making within household.

It helps individuals and families to effectively manage their resources, making informed financial choices and achieve their financial goals.

- Computer Science

Computer has automated tools that enhance financial record-keeping, data analysis, security measures, and reporting processes. order to do that, one needs to have Book- keeping knowledge and skills.

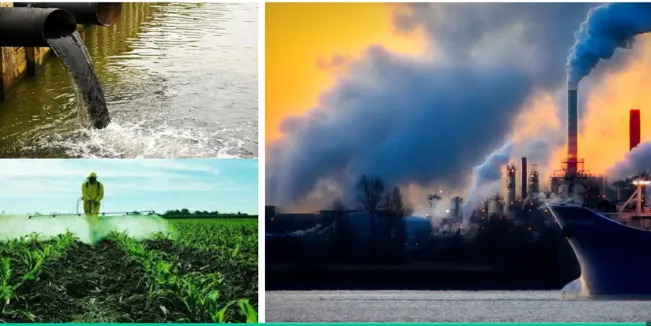

- Agriculture

Helps farmers to maintain financial records, assess profitability, optimize resource allocation, comply with tax obligations, and make informed decisions to achieve sustainable and profitable agricultural operations.

In order to do that, one needs to have Book-keeping knowledge and skills.

Leave a Reply