Topic 4- Partnerships – Book Keeping Form 4

The Basic Characteristics of a Partnership

Definition:

Another person who is a good manager but may not have capital. When these persons come together, pool their capital and skills and organise a business, it is called partnership. Partnership grows essentially because of the limitations or disadvantages of proprietorship.

More Persons:

As against proprietorship, there should be at least two persons subject to a maximum of ten persons for banking business and twenty for non-banking business to form a partnership firm.

Profit and Loss Sharing: There is an agreement among the partners to share the profits earned and losses incurred in partnership business.

Contractual Relationship: Partnership is formed by an agreement-oral or written-among the partners.

Existence of Lawful Business:

Partnership is formed to carry on some lawful business and share its profits or losses. If the purpose is to carry some charitable works, for example, it is not regarded as partnership.

Utmost Good Faith and Honesty: A partnership business solely rests on utmost good faith and trust among the partners.

Unlimited Liability:

Like proprietorship, each partner has unlimited liability in the firm.

This means that if the assets of the partnership firm fall short to meet the firm’s obligations, the partners’ private assets will also be used for the purpose.

Restrictions on Transfer of Share: No partner can transfer his share to any outside person without seeking the consent of all other partners.

Principal-Agent Relationship:

The partnership firm may be carried on by all partners or any of them acting for all. While dealing with firm’s transactions, each partner is entitled to represent the firm and other partners. In this way, a partner is an agent of the firm and of the other partners.

The Importance of Mutual Agency and Unlimited Liability to a Person about to become a Partner

Explain the importance of mutual agency and unlimited liability to a person about to become a partner

Advantages:

Easy Formation:

Partnership is a contractual agreement between the partners to run an enterprise. Hence, it is relatively ease to form. Legal formalities associated with formation are minimal. Though, the registration of a partnership is desirable, but not obligatory.

More Capital Available:

We have just seen that sole proprietorship suffers from the limitation of limited funds. Partnership overcomes this problem, to a great extent, because now there are more than one person who provide funds to the enterprise. It also increases the borrowing capacity of the firm.

Moreover, the lending institutions also perceive less risk in granting credit to a partnership than to a proprietorship because the risk of loss is spread over a number of partners rather than only one.

Combined Talent, Judgement and Skill:

As there are more than one owners in partnership, all the partners are involved in decision making. Usually, partners are pooled from different specialised areas to complement each other. For example, if there are three partners, one partner might be a specialist in production, another in finance and the third in marketing. This gives the firm an advantage of collective expertise for taking better decisions. Thus, the old maxim of “two heads being better than one” aptly applies to partnership.

Diffusion of Risk:

You have just seen that the entire losses are borne by the sole proprietor only but in case of partnership, the losses of the firm are shared by all the partners as per their agreed profit-sharing ratios.

Thus, the share of loss in case of each partner will be less than that in case of proprietorship.

Flexibility: Like

proprietorship, the partnership business is also flexible. The partners can easily appreciate and quickly react to the changing conditions. No giant business organisation can stifle so quick and creative responses to new opportunities.

Tax Advantage: Taxation rates applicable to partnership are lower than proprietorship and company forms of business ownership.

Disadvantages:

Descriptions of these drawbacks/ disadvantages are as follows:

Unlimited Liability:

In partnership firm, the liability of partners is unlimited. Just as in

proprietorship, the partners’ personal assets may be at risk if the

business cannot pay its debts.

Divided Authority:

Sometimes the earlier stated maxim of two heads better than one may

turn into “too many cooks spoil the broth.” Each partner can discharge

his responsibilities in his concerned individual area. But, in case of

areas like policy formulation for the whole enterprise, there are

chances for conflicts between the partners. Disagreements between the

partners over enterprise matters have destroyed many a partnership.

Lack of Continuity:

Death or withdrawal of one partner causes the partnership to come to an

end. So, there remains uncertainty in continuity of partnership.

Risk of Implied Authority:

Each partner is an agent for the partnership business. Hence, the

decisions made by him bind all the partners. At times, an incompetent

partner may lend the firm into difficulties by taking wrong decisions.

Risk involved in decisions taken by one partner is to be borne by other

partners also. Choosing a business partner is, therefore, much like

choosing a marriage mate life partner.

Difference between an Ordinary Partnership and Limited Partnership

Distinguish between an ordinary partnership and limited partnership

partnership (also referred to as a general partnership) is a business

arrangement where two or more people (who are not husband and wife) are

owners of a business. Unlike a corporation, you do not need to file any

documents with the state to make your business a partnership. A

partnership is created by default, unless the business is specifically

formed as some other type of business entity, such as a corporation, a

limited liability company, or a limited partnership.

general partnership is one in which all of the partners have the

ability to actively manage or control the business. This means that

every owner has authority to make decisions about how the business is

run as well as the authority to make legally binding decisions. Unless

the partners have a partnership agreement, each partner will have equal

authority.

in a general partnership don’t have any limit on their personal

responsibility for the debts of the business. This means that the

partner could lose more than just his investment in the business –

personal assets would have to be used to pay business debts if

necessary. Each partner in a general partnership is also “jointly and

severably” liable for debts of the business. Joint and severable

liability means is that each partner is equally liable for the debts of

the business, but each is also totally liable. So if a creditor can’t

get what he is owed by one or more of the partners, he can collect it

from another partner, even if that partner has already paid his share of

the total debt. If someone sues your partnership and obtains a large

judgment, and your partner doesn’t have the money to pay his share of

it, you will have to pay the entire amount.

limited partnership is different from a general partnership in that it

requires a partnership agreement. Some information about the business

and the partners must be filed with the appropriate state agency

(usually the secretary of state).

a limited partnership has both limited and general partners. A limited

partner is one who does not have total responsibility for the debts of

the partnership. The most a limited partner can lose is his investment

in the business. The trade off for this limited liability is a lack of

management control: A limited partner does not have the authority to run

the business. He is really more or less an investor in the business.

limited partnership must have at least one general partner. The general

partner or partners are responsible for running the business. They have

control over the day-to-day management of the business and have the

authority to make legally binding business decisions. The partnership

agreement will specify exactly which partner or partners have certain

responsibilities and which have certain authority. General partners are

also subject to unlimited personal liability for the debts of the

business. The general partners of a limited partnership are also jointly

and severably liable for the debts of the business, just like partners

in a general partnership. If you need a business type that limits the

liability of all partners.

agreement (also known as the partnership deed) is the agreement between

the partners. It is ideally in written form and it documents the rights

and responsibilities of the partners and addresses other matters to

which the partners agree at the time of partnership formation.

partners have to satisfy the relevant state’s legal requirements

related to formation of partnerships, obtain tax number for the

business, obtain any required licenses (such in public accounting, etc.)

and agree on the terms of the partnership with each other.

of a partnership involves investment by the partners in the partnership

either in the form of cash or in the form of assets. When partners

introduce cash or any other asset, cash or the other asset account is

debited at the value agreed by the partners and the corresponding

partner’s capital account is credited by the same amount.

Example 1

Consultancy is a partnership established by Jazz and Indigo. The

business is engaged in providing consultancy to telecommunication

companies on revenue assurance. On 1 January 20X2, Jazz contributed

contribute cash of $300,000 while Indigo introduced a vehicle with a

written down value of $40,000 and fair value of $80,000, paid 2 years

prepaid rent for office building of $70,000 and introduced technical

equipment of $60,000 and marketable securities of $100,000. A firm of

Indigo’s friend did the furnishing work for $70,000 and JI Consulting

agreed to pay off the loan in the first week of the partnership’s

formation. Journalize the formation of the partnership.

The

formation of partnership would involve recording the assets on the

partners’ balance sheet and creating corresponding capital accounts by

the following journal entry:

| DR | CR | |

| Cash | 300,000 | |

| Marketable securities | 100,000 | |

| Prepaid | 70,000 | |

| Furniture and fittings | 70,000 | |

| Vehicles | 80,000 | |

| Equipment | 60,000 | |

| Sales | 70,000 | |

| Sales | 300,000 | |

| Sales | 310,000 |

B and C are partners in a partnership firm with capital A- Rs.5,00,000;

B- Rs.7,00,000 and C- Rs4,00,000. During the year 2012, the firm earned

a net profit of Rs. 2,00,000. The partners are to entitled to an

interest on capital @ 6% p.a. They also made some drawings on which

interest to be charged is A-Rs.400; B-Rs 500 and C- Rs250. A is entitled

to Rs.2000 p.m. as salary. B is to get 5% of the net profit after all

adjustments as commission. Also 10% of the profits remaining before

providing commission to B is to be transferred to General Reserve.

Profit are shared among A, B and C in the ratio 1:1:2 respectively.

Prepare Profit and Loss Appropriation account to show the above

adjustments.

| Particulars | Amount(Rs) | Particulars | Amount(Rs) |

| To Interest on Capital: | By Net Profit | 2,00,000 | |

| A-Rs. 30,000 | By Interest On Drawings | ||

| B-Rs. 42,000 | A- 400 | ||

| C-Rs.24,000 | 96,000 | B- 500 | |

| To Salary (A) | 24,000 | C-250 | 1,150 |

| To General Reserve | 8,115 | ||

| To Commission (B) | 7,303 | ||

| To Profit transferred to: | |||

| A-16,433 | |||

| B-16,433 | |||

| C-32,866 | 65,732 | ||

| 2,01,150 | 2,01,150 |

Earnings to Partners: On a Sated Fractional Basis; In the Partners

Capital Ratio and through the Use of Salary and Interest Allowances

partnership earnings to partners: On a stated fractional basis; In the

partners capital ratio and through the use of salary and interest

allowances

partnership earnings to partners: On a stated fractional basis; In the

partners capital ratio and through the use of salary and interest

allowances

upon the share of profits to be given to the new partner, either a sum

of money will be directly paid by him to the old partners (through the

firm or privately) or after recording new partner’s capital, new

partner’s capital account will be debited with his share of goodwill,

the credit being given to the old partners in the ratio of their

sacrifice of future profits. The latter is an indirect method of payment

for goodwill by the new partner. The payment is justified became the

new partner will take a share of profits which comes out of the shares

of other partners. The old partners must be compensated for such a loss.

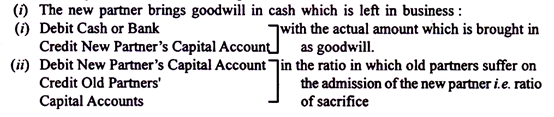

- The new partner brings goodwill in cash which is left in the business.

- The new partner brings goodwill in cash but the cash is withdrawn by the old partners.

- The amount of goodwill is paid by the new partner to the old partners privately.

- The

new partner does not bring in cash for goodwill as such; but an

adjustment entry is passed by which the new partner’s capital account is

debited with his share of goodwill and the amount is credited to old

partners’ capital accounts in the ratio of sacrifice. This entry reduces

the capital of the new partner by the amount of his share of goodwill

and results in payment for goodwill by the new partner to the old

partners.

considering the entries to be made in the above cases, one must decide

regarding the ratio in which goodwill is to be credited to the old

partners. Traditionally, goodwill was credited to the old partners in

the old profit-sharing ratio and, if the amount was to be written off as

in case (v) above, it was written off to all the partners in the new

profit-sharing ratio.

would be no doubt that this should be the case when, on the admission

of a new person as partner, the ratio as among the old partners does not

change. But what if on the admission of a new partner, the

profit-sharing ratio of old partners as among themselves is also

changed.

one treats paying sums in respect of goodwill to old partners as

compensation for their surrendering to the new partner a part of their

profits, then obviously the amount to be credited to partners should be

in then ratio of loss of profits. Suppose, A and B, sharing in the ratio

of 3: 2, admit C as partner and it is agreed that the new

profit-sharing ratio is 2: 2: 1. It is obvious that B does not suffer at

all on Cs admission. He previously received 2/5ths of profits; he still

receives 2/5ths of profits. It is A alone who has suffered and,

therefore, any amount brought in as goodwill by C should be credited to

only A. Thus, it is proper to credit goodwill brought in by a new

partner to the old partners in the ratio in which they suffer on the

admission of the new partner.

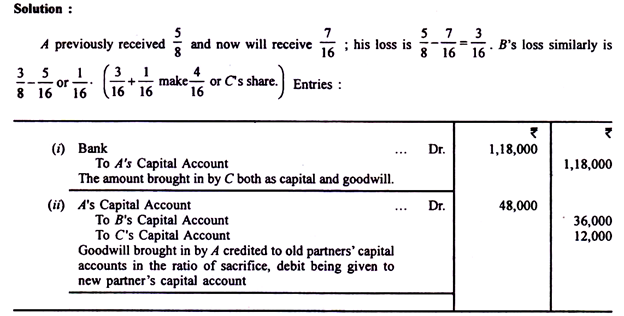

and B share profits in the ratio: A, 5/8 and B 3/8. C is admitted as

partner. He brings in Rs 70,000 as his capital and Rs 48,000 as

goodwill. The new profit-sharing ratio among A, B and C respectively is

agreed to be 7: 5: 4 respectively. Pass Journal entries.

the above illustration, the old partners have allowed the amounts of

goodwill credited to their capital accounts remain in the business.

However, the arrangement may allow the old partners to wholly or partly

withdraw the amounts of goodwill credited to their capital accounts.

Suppose, in the above illustration, A and B withdraw their shares of

goodwill A and B withdraw their shares of goodwill brought in by C.

the case is that the amount of goodwill is paid by the new partner to

the old partners privately, no entry is passed in the books of the firm.

But the calculations have to be made in the same manner as shown above.

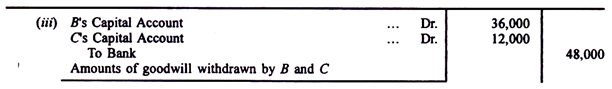

and B are partners sharing profits and losses in the ratio 3:2

respectively. They admit C as partner who is unable to bring goodwill in

cash but pays Rs 96,000 as his capital. The goodwill of the firm is to

be valued at two years’ purchase of three years’ profits. The profits

for the three years were Rs 30,000, Rs 24,000 and Rs 27,000. An

adjustment entry is to be passed for C’s share of goodwill. The new

ratio will be 5: 2: 2. Pass journal entries.

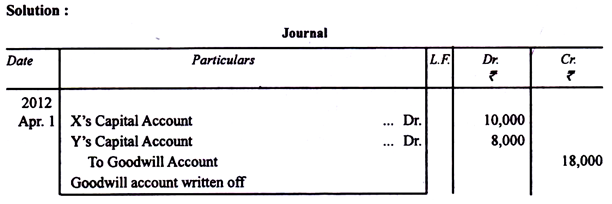

and Y were partners sharing profits in the ratio of 5:4 respectively.

On 1st April, 2012 they admitted Z as a new partner; all the partners

agreeing to share future profits equally. On the date of admission of

the new partner, there was a goodwill account in the old firm’s ledger

showing a balance of Rs 18,000. The current value of firm’s goodwill was

placed at Rs 36,000. Z paid Rs 50,000 by way of his capital. He also

paid an appropriate amount for his share of goodwill. X and Y wrote off

the goodwill account before Z’s admission.

a new partner is admitted, it is natural that he should not benefit

from any appreciation in the value of assets which has occurred (nor

should he suffer because of any fall which has occurred up to the date

of admission) in the value of assets. Similarly, for liabilities.

assets and liabilities are revalued and the old partners are debited or

credited with the net loss or profit, as the case may be, in the ratio

in which they have been sharing profits and losses hitherto. Partners

may agree that the change in the value of assets and liabilities is to

be adopted and figures changed accordingly or that the assets and

liabilities should continue to appear in the books of the firm at the

old figures.

- Values

to be altered in books. In this case, a Profit and Loss Adjustment

Account (or Revaluation Account) is opened and the following steps

should be taken

If the values of assets increase, the particular assets should be

debited and the Revaluation Account credited with the increases only.

If the values of assets fall, the Revaluation Account should be debited

and the particular assets credited with the fall in values.

the value of debtors, investments or stock falls, the entry should be

to debit the Revaluation Account and credit a suitable provision

account. Thus, suppose it is desired to record a fall in value of

investments to the extent of Rs 9,500.

The entry is:

there is already a provision against a particular asset and the value

of that asset increases, the entry should be to debit the Provision and

credit Revaluation Account rather than to follow (a) above.

Any reduction in the amounts of liabilities is a profit and hence the

liabilities accounts should be debited and Revaluation Account credited

with the difference between the old and present figures.

The Revaluation Account should then be closed by transfer to old

partners’ capital (or current) accounts in the old profit-sharing ratio.

If debits exceed the credits, it is a loss and the entry is to debit

partners’ capital (or current) accounts and credit Revaluation Account.

Reverse entry is made when the credits exceed debits.

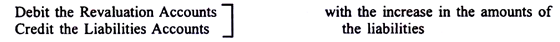

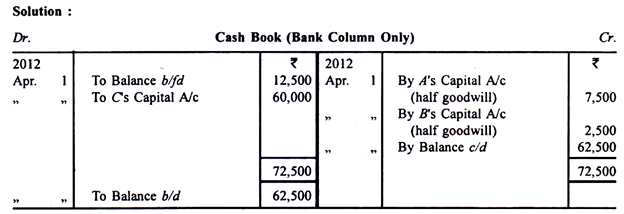

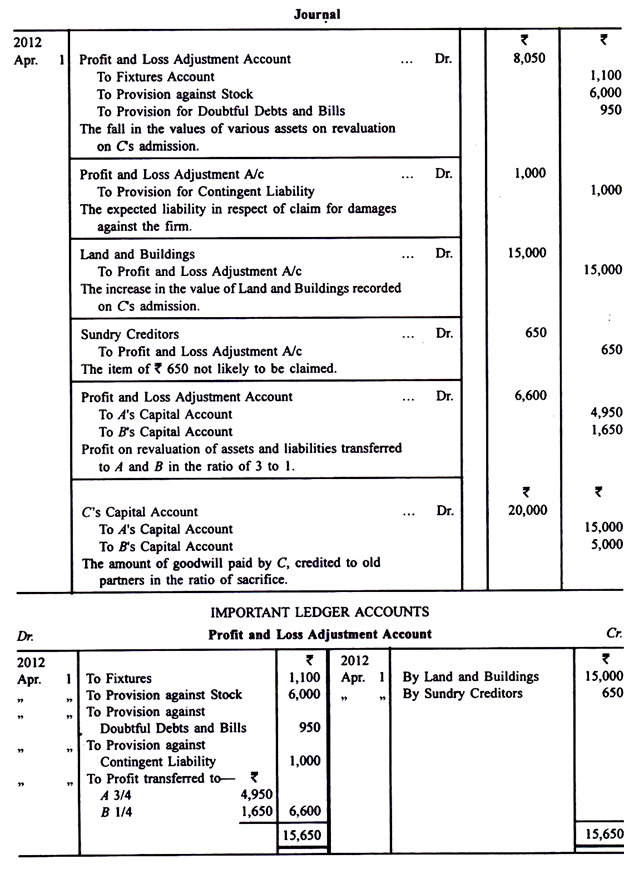

- That C pays Rs 40,000 as his capital for a fifth share.

- That C pays Rs 20,000 for goodwill. Half of this sum is to be withdrawn by A and B.

- That

Stock and Fixtures be reduced by 10% and a Provision for Doubtful Debts

amounting Rs 950 be created on Sundry Debtors and Bills Receivable. - That the value of Land and Buildings be appreciated by 20%.

- There being a claim against the firm of damage, a liability to the extent of Rs 1,000 should be created.

- An item of Rs 650 included in Sundry Creditors is not likely to be claimed and hence should be written off.

journal entries for the above-mentioned transactions excluding cash

transactions; prepare cash book and important ledger accounts. Also

prepare the balance sheet of the firm immediately after Cs admission.

Assume the profit-sharing ratio as between A and B has not changed.

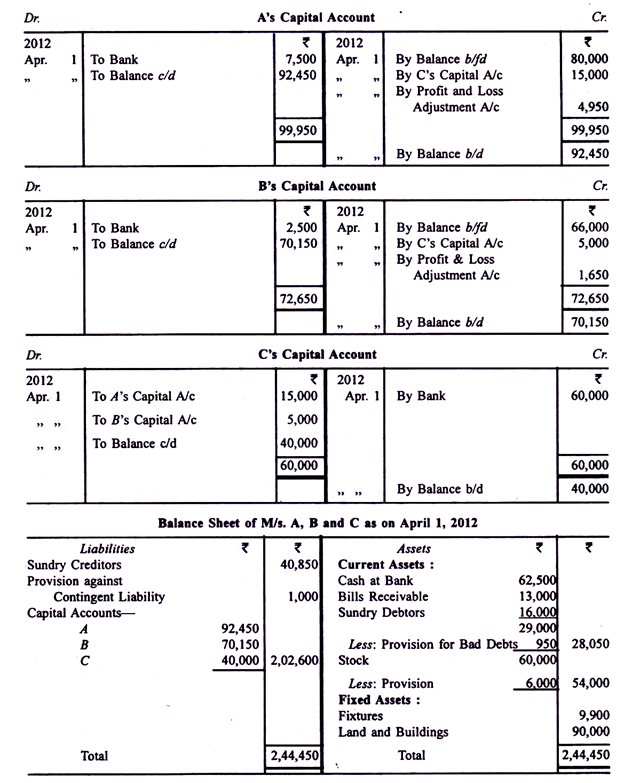

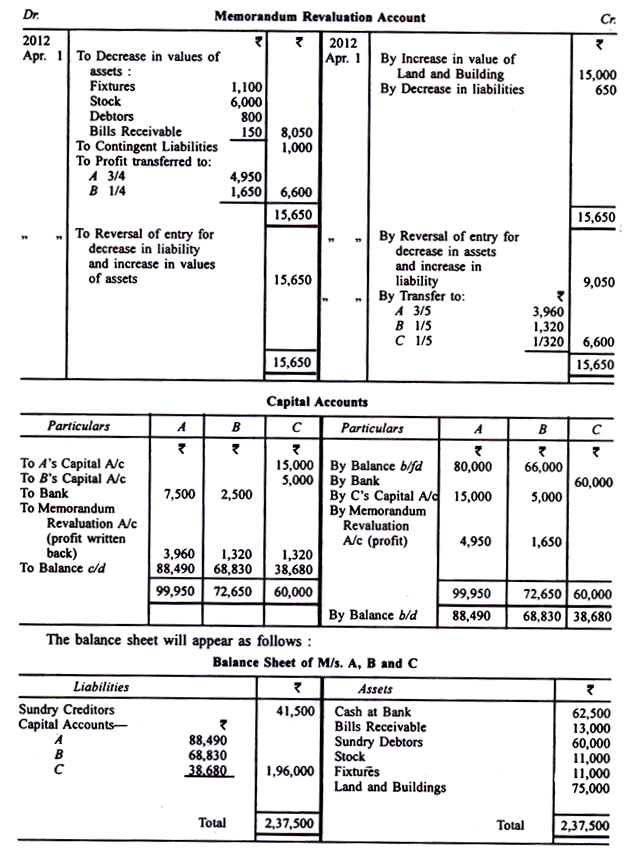

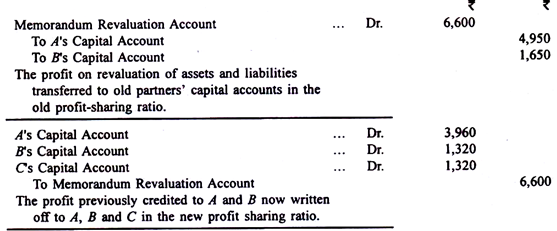

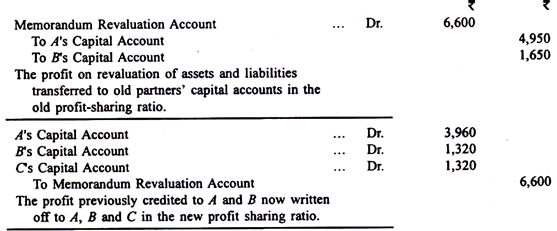

When values are not to be altered. In this case, the increases and

decreases in the values of assets and liabilities are entered in a

Memorandum Revaluation Account without passing corresponding entries in

the assets and liability accounts. The balance is transferred to old

partners’ capital accounts in the old profit-sharing ratio. Then,

entries passed in Memorandum Revaluation Account for increases and

decreases in the values of assets and liabilities are reversed, again

without passing any entry in the assets and liability accounts. The

balance of Memorandum Revaluation Account is, this time, transferred to

all partners (including the new one) in the new profit-sharing ratio.

the illustration above, the Memorandum Revaluation Account and the

capital accounts will appear as follows if this method is to be

followed:

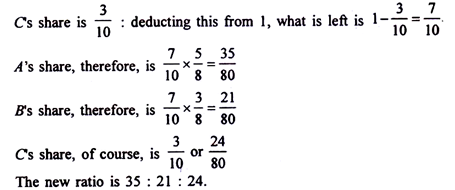

out the new profit-sharing ratio might involve a little calculation.

The language of the agreement is the most important factor. In some

cases, the new ratio is given. In others, only the share to be given to

the new partner is given; the assumption is that as amongst the old

partners, the ratio does not change. In such a case, one should deduct

from 1 the share of the new partner and then divide the remainder among

the old partners in the old ratio. Suppose, A and B are partners sharing

profits and losses in the ratio of 5: 3 respectively. They admit C and

agree to give him 3/10 of the profits.

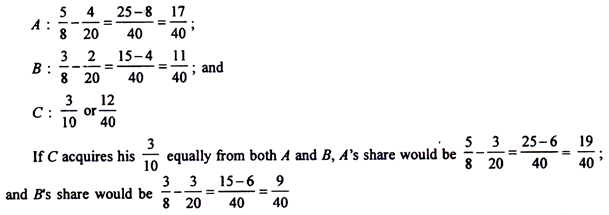

certain cases, the incoming partner “purchases” his share from the

other partners in different proportions. Suppose, A and B sharing

profits in the ratio of 5: 3 respectively admit C giving him a 3/10

share of profits of the firm. If C acquires 4/20 share from A and 2/20

share from B, the new ratio will be

Glucose and Cibazol have a practice producing Rs 3,72,900 per annum,

which they divide in proportions of 17/33 and 16/33. They admit Dr.

Zambuck to partnership on the basis of his buying, at 2 years’ purchase,

5/17 of Dr. Glucose’s share and 4/16 of Dr. Cibazol’s share. After the

lapse of three years, they permit Dr. Zambuck to purchase a further 1/12

of their remaining shares. How much did Dr. Zambuck pay to each of the

others on each occasion, and what is the ultimate share of each partner

in the practice?

first, Dr. Zambuck buys 5/17 of Dr. Glucose’s share. That comes to

(5/17) x (17/33) or 5/33 Dr. Glucose’s share, therefore, is

(17/33)-(5/33) or 12/33. Dr. Zambuck acquires (4/16)x (16/33) or 4/33

from Dr. Cibazol whose share, therefore, is (16/33)-(4/33) = 12/33.

Total share of Dr. Zambuck is [(5/33) + (4/33)] or 9/33. Goodwill is

valued at Rs 3,72,900 x 2 or Rs 7,45,800. Therefore, Dr.Zambuck has to

pay Rs 7,45,800 x 9/33 or Rs 2,03,400 which is shared by Dr. Glucose and

Cibazol in the ratio of 5 : 4 (the ratio in which they lose profits).

Rs 1, 13,000 will go to Dr. Glucose and Rs 90,400 to Dr. Cibazol. The

new ratio is 12/33,12/33 and 9/33. Later, Dr. Zambuck acquires 1/12 of

each partner’s share. Hence, he acquires 12/33 x 1/12 or 1/33 from both

the other partners. The share of Dr. Glucose is reduced to 12/33-1/33 or

11/33. So also for Dr. Cibazol. The share of Dr. Zambuck comes to be

9/33 + 1/33 + 1/33 = 11/33. Hence, all partners are now equal. Dr.

Zambuck will have to pay 7,45,800 x 1/33 or ? 22,600 to each of the

other two partners by way of goodwill.

existing at the time of the admission of a new partner should always be

transferred to the capital or current accounts of the old partners in

the profit-sharing ratio. Students should remember to do this even if

the question is silent on the point.

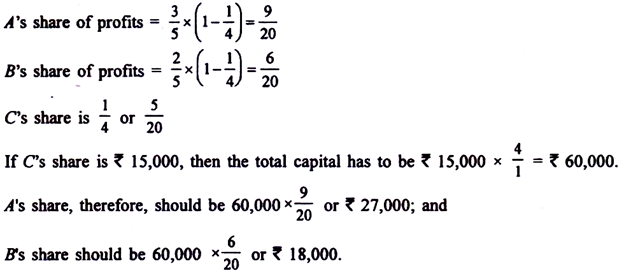

is often agreed on admission of a partner that the capitals of all

partners should be in proportion to their respective shares in profits.

The starting point may be the new partner’s capital or the new partner

himself may be required to bring in capital equal to his share in the

firm. If the new partner’s capital is given, one should find out the

total capital of the firm on the basis of his share.

the capital required of other partners should be ascertained. Suppose, C

is admitted in a firm with a 1/4 share of the profits of the firm. C

contributes Rs 15,000 as his capital, A and B, the other two partners,

were sharing profits in the ratio of 3: 2.

is similar if the basis is the existing partners’ capitals and the new

partner is required to bring in proportionate capital. Suppose, after

making all adjustments as regards goodwill and revaluation of assets,

etc., the capitals of A and B are ?20,000 and Rs 16,000. The profits and

losses are shared by A and B in the ratio of 5: 3 respectively. C is

admitted and is to be given 1/4th share of profits. He has to bring in

capital representing his share. C gets 1/4, 3/4 is left for A and B.

the combined capital of A and B, viz., Rs 36,000 represents 3/4 share.

Total capital should be 36,000 x4/3 or Rs 48,000. C should bring Rs

12,000, i.e., 48,000 x 1/4. In other words, C’s share is 1/3 of the

combined shares of A and B (1/4:3/4); his capital should be 1/3 of the

combined capitals of A and B.

the actual capital of a partner is more than his proportionate share,

the difference should be credited to his current account. If the actual

is less, he should being in the requisite amount of cash or else his

current account should be debited. If the Partnership Deed requires

capitals to be proportionate to the profit-sharing ratio, the capitals

should be treated as fixed.

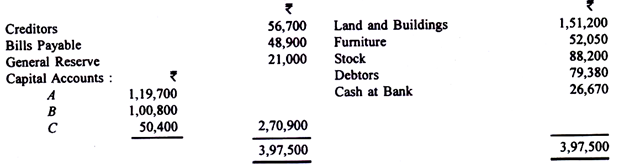

following was the Balance Sheet of A, B and C sharing profits and

losses in the proportion of 6/14, 5/14 and 3/14 respectively:

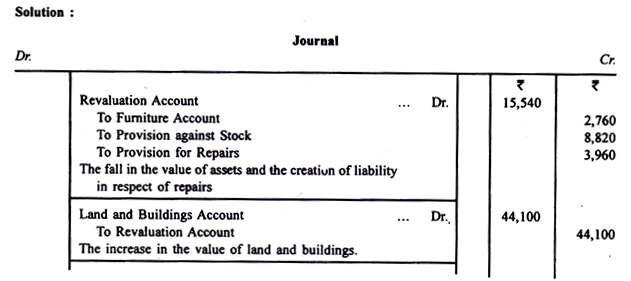

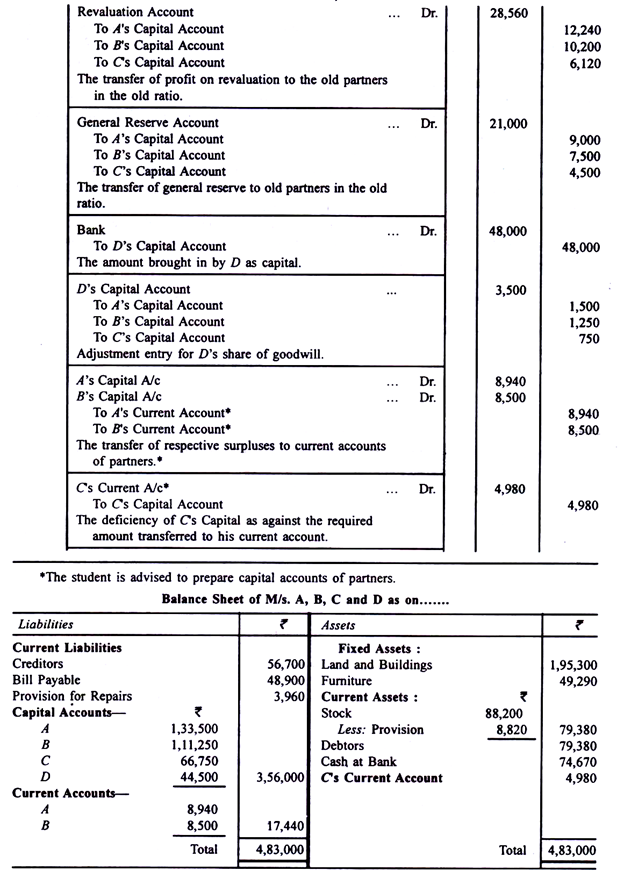

- (1) That D brings in Rs 48,000 as his capital.

- That furniture be written down by Rs 2,760 and stock be depreciated by 10%.

- That provision of Rs 3,960 be made for outstanding repair bills.

- That the value of land and buildings be written up to Rs 1,95,300.

- That the value of goodwill be fixed at Rs 28,000 and an adjustment entry be passed for D’s share of goodwill.

- That the capitals of A, B and C be adjusted on the basis of D’s capital by opening current accounts.

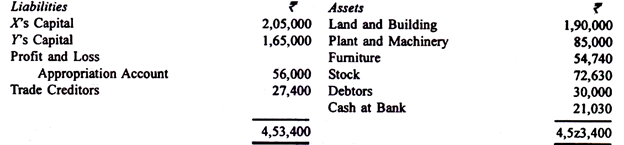

balance sheet of a partnership firm of X and Y, who were sharing

profits in the ratio of 5: 3 respectively, as on 31st March, 2012 was as

follows:

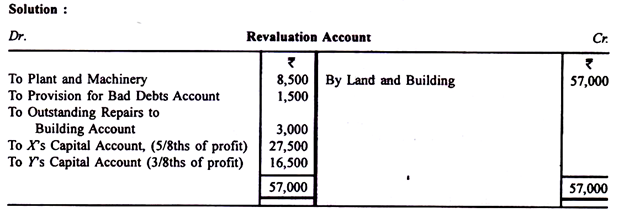

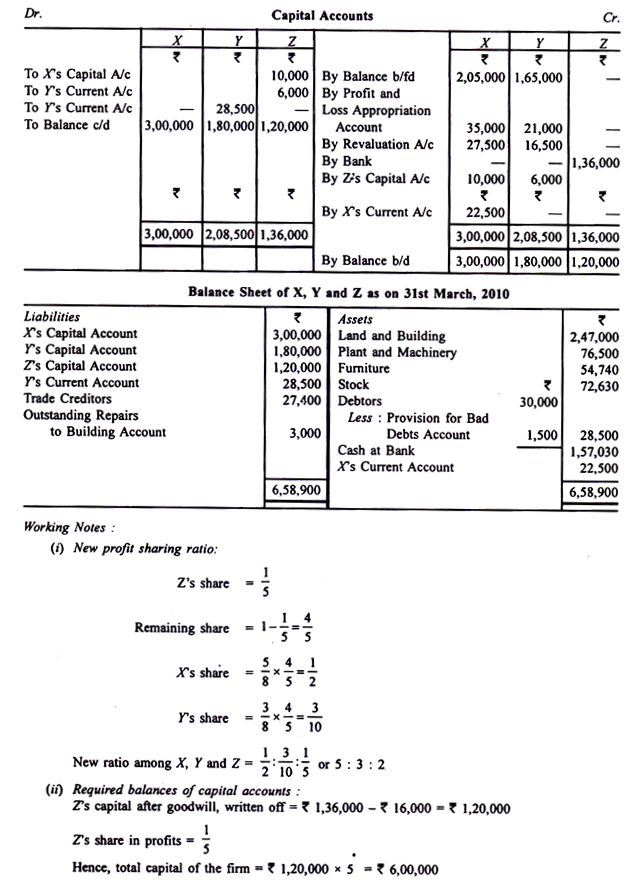

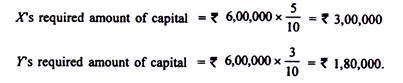

- Z would get 1/5th share in the profits.

- Z would pay Rs 1, 20,000 as capital and Rs 16,000 for his share of goodwill.

- Machinery

would be depreciated by 10% and building would to be appreciated by

30%. A provision for bad debts @ 5% on debtors would be created. An

unrecorded liability amounting to Rs 3,000 for repairs to building would

be recorded in the books of account. - Immediately after Z’s

admission, goodwill account would be written off. Thereafter, the

capital accounts of the old partners would be adjusted through the

necessary current accounts in such a manner that the capital accounts of

all the partners would be in their profit showing ratio. Prepare

revaluation account, capital accounts and the initial balance sheet of

the new firm.

PARTNERSHIPS

Leave a Reply