Topic 2: Business Units – Business Studies Notes Form Five

The nature and forms of businesses operating in different countries depend on size, ownership structures, and industrial sector. This brings us to the basic aspects of a business unit.

In this chapter, you will learn about the concept of business unit, and the forms of business units according to size and ownership structure. The competences developed will enable you to establish and operate a company, franchise, joint venture, and co-operative.

Think

Operating a business of any form.

The concept of business Unit

A business unit is an organisation, enterprise, or firm that deals with the production, distribution, or exchange of products to make profits. It may be set up by an individual or a group of individuals. Business units have different classifications as explained

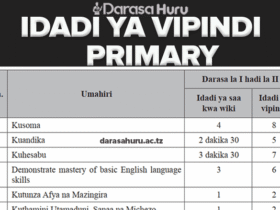

Size classification of businesses is a method that is used to categorise businesses according to metrics such as annual turnover, number of employees, or value of assets.

This classification aids stakeholders in understanding the business landscape and tailoring regulations and policies to support different businesses according to their sizes. Globally, businesses are also classified according to various measures including the nature of the market, capital requirements, regulatory environment, and level of technology adapted depending on the level of a country’s development.

In Tanzania, the size classification of businesses is guided by the indicators provided in the Tanzania Small and Medium Enterprise (SME) Development Policy of 2003. The policy defines the business size from micro to large enterprises as shown in Table 2.1.

| Category | Number of employees | Capital investment in machinery (TShs) |

| Micro enterprise | 4-Jan | Up to 5 million |

| Small enterprise | May-49 | Above 5 million to 200 million |

| Medium enterprise | 50 – 99 | Above 200 million to 800 million |

| Large enterprise | 100+ | Above 800 million |

NB: In the event of an enterprise falling under more than one category, then the level of investment will be the deciding factor.

Exercise 2.1

Reflect on the meaning of business unit, then, provide examples of business units operating in your area and explain their importance to the community.

Ownership structure of business units

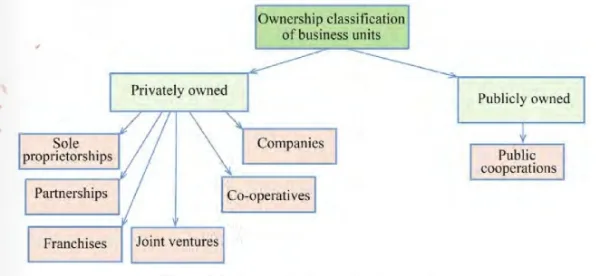

Business units are classified into two forms of ownership, that is public and private.

Public ownership consists of businesses owned partially or totally by the government such as parastatals and corporations. Private ownership consists of businesses that are owned privately by individuals or groups such as sole proprietorship. Figure 2.1 provides details on some forms of business units according to ownership, however, in this book only companies, franchises, joint ventures, and co-operatives forms are described.

Company

A company is a corporate association of persons formed to carry out specific functions to generate profit. It is a ‘corporate body’ created under the law and it exists on its own, separate from the members who comprise it. In the eyes of the law, a company is an artificial person that can enter into contracts, own properties, incur liabilities, sue others, be sued by others, and do anything for which it has been formed for. Examples of companies in Tanzania are Tanzania Commercial Bank (TCB), the People’s Bank of Zanzibar (PBZ), Air Tanzania Company Limited (ATCL), and Tanzania Electric Supply Company Limited (TANESCO).

Types of companies

Companies are classified based on the nature of capital, ownership, control or holding, access to capital, and other factors as follows:

Classification of companies based on

Based on the nature of capital, companies are classified as follows:

Companies limited by shares: In these kinds of companies, the liabilities of members are limited to the extent of the number of fully paid-up shares. This means that in case of winding up, members will be liable only for the number and value of shares that have been fully paid for.

Companies limited by guarantee: These are companies without any shareholder but are owned by members called guarantors who agree to pay a nominal amount of

debts or liabilities in the event of winding up. The profit earned by the companies is re-invested in the company to be used for different purposes. For example, most of the non-profit making companies operate as companies limited by guarantee such as TPSF.

Unlimited companies: These are companies without limits on their members’ assets. In these companies’ shareholders become liable for all the debts of the company in case the company becomes insolvent. If the company does not have sufficient assets to pay all the liabilities during its winding up, the personal belongings of shareholders will be used to compensate for the deficit.

Classification of companies based on ownership

The classification of companies based on ownership is as follows:

Private companies: These are those companies whose articles of association restrict the free transferability of shares. In terms of members, private companies need

to have a minimum of two and a maximum of fifty members.

Public limited companies: These companies allow their members to freely transfer their shares to others. They need to have a minimum of seven members, but they have unlimited maximum number of members. Most large-scale industrial and commercial companies fall under this type of company.

Classification of companies based on control or holding

The classification of companies based on control or holding is as follows:

Holding and subsidiary or group companies: In some cases, the company’s shares might be held fully or partly by another company. The company owning these shares becomes the holding or parent company. Likewise, the company whose shares are owned by the parent company becomes a subsidiary company. Holding companies may exercise control over their subsidiaries. Thus, when company “A” holds more than 50 per cent shares of company B, then company “A” is the parent or holding company and company “B” is a subsidiary company.

Associate or affiliate companies: These are those in which other companies have significant influence. This implies control of at least 20 percent and not more than 50 percent of total share capital of a company.

Classification of companies in terms of access to capital

The classification of companies in terms of access to capital is as follows:

Listed companies: These companies have their securities listed on stock exchange markets. This means persons can freely buy and sell their shares. In such markets, public companies are commonly listed.

Unlisted companies: These companies, do not list their securities on stock exchange markets. Private companies can fall under this category.

Other classifications of companies

The following are other types of companies:

Government companies: These are those in which more than 50 percent of share capital is held by either the central government, or by one or more state governments, or jointly by the central government and one or more state governments.

Foreign companies: These are those that are incorporated or registered under the laws of one state but perform their businesses outside their domestic country.

Charitable companies under certain specific sections: Certain companies have charitable purposes as their objectives. Charitable companies focus on the promotion of arts, science, culture, religion, education, sports, trade, and commerce as their objectives. These companies are not for profit making; hence they do not pay any dividends to their members.

Dormant companies: These are companies that exist but are inactive in a given period. These companies are generally formed for future projects. They do not have significant accounting transactions and do not have to carry out all compliance with regulatory authorities.

Activity 2.1

(a) Search details of companies operating internationally, then:

(b) Identify at least 10 of those companies operating in Tanzania.

(c) Categorise the companies identified in part (b) based on the types of companies. Provide reasons for your answers.

Features of a company

The following are the features of a company:

Separate legal entity: There is a clear line of separation between the business and its owners. The business assets are separate from those of the owners or shareholders.

Perpetual succession: Companies are established with a belief of indefinite operation. This means companies are designed in such a way that the death of any member will not significantly affect the continuity or going concern of the company.

Control: Companies are always managed by the board of directors who act on behalf of the owners. They are responsible for appointing and guiding the top management

and overseing the daily functioning of the company.

Liability: Contrary to the unlimited companies, limited companies have limited liability. The liabilities of owners of the business are limited to the amount of

capital they have agreed to contribute or the amount of capital guaranteed by owners

Common, seal: Since there are many owners of a company, a common seal is prepared to identify all of them as one. The common seal is required to appear in all dealings of the company to guarantee the involvement of the company. In the absence of such a seal, company participation is not guaranteed and hence exempted.

Risk sharing: This is when the risk of the company is borne by every owner of the company and is limited to the amount of capital they have agreed to contribute. As the amount is borne by many, the risk is spread out and thus, reducing its impact on an individual shareholder.

Advantages of a company

Operating a business as a company has the following advantages:

Encourages business expansion: It is easy for a company to grow since a company’s capital can be raised from different sources. Therefore, expanding the business becomes easier. Companies can increase their capital by issuing more shares or debentures. They can also use their reserves to fund their expansion.

Transfer of ownership: For public companies shareholders are free to sell their shares at any moment in the stock market. This makes the company’s ability to continue with operation regardless of the transition in ownership (change in ownership).

Limited liability: Unless otherwise stated, the liability of sharcholders is limited to the amount of capital they have agreed to contribute or the guarantee that a shareholder provides. If the company fails to meet its obligations to pay creditors, the personal property of shareholders will not be taken to pay the company’s liabilities.

Presence of professional management: The management of a company is in the hands of the board of directors who are elected by the shareholders and have extensive expertise. Salaried professional managers are hired to oversee the day-to-day operations of a company hence, the company is provided with expert management.

Disadvantages of a company

A company has the following disadvantages:

Absence of direct control by shareholders: The owners (shareholders) do not have direct control over the running of the business. Only the expert directors have

control of the business through the positions they hold in the company.

Lack of secrecy: Due to legal requirements, a company must make numerous financial statements available to the registrar of companies, financial institutions, and the

general public. Hence, commercial secrecy is compromised. It is further lowered when the company issues its annual report to shareholders, as competitors can have access to all financial information.

Complex and costly formalities: In forming and registering companies, there are various requirements and procedures to be followed. Also, companies operations are guided by complex regulations that must be adhered to. Adhering to such formalities may be costly and time consuming.

Possibility of misallocation of resources: There is a possibility of companies being operated by other people rather than their owners. The management operating the company may abuse their powers and conduct fraudulent activities for their personal gains. This leads to misallocation of company’s resources.

Lack of personal interest: Unlike proprietorship and partnership, salaried managers handle a company’s day-to- day operations. Salaried managers then, may have little personal interest and dedication to the company since they are only employees not owners.

Double taxation: After paying out all salaries, bonuses, overheads, and other expenses, the company also pays taxes on profits. Even though the company’s profit is taxed as a corporate tax, still the dividends paid to the stakeholders are taxed as a withholding tax, thus, leading to double taxation.

Formation of a company

The process of forming a company begins with promoters. Promoters are the founders of a company. They take initiatives to create the company’s plan.

Once the plan is finalized, the promoter applies to the registrar of companies for permission to establish the company. This application includes the submission of two essential documents: the memorandum of association, and articles of association.

Upon submission of these documents, the registrar reviews the application for compliance and if all prescribed conditions are met, the registrar grants permission for the formation of the company. This approval is formally recognised through the issuance of the Certificate of Incorporation and the Certificate of Registration.

With the receipt of these documents, the company is officially empowered to commence its operations in accordance with the laws of the country signifying its legal existence as a corporate entity.

The memorandum of association, and articles of association are explained as follows:

Memorandum of association

A memorandum of association is a legal document that outlines the key principles and objectives upon which a company is formed. It serves as the constitution of a company and it contains all essential information about the company’s structure, purpose, and powers. The memorandum of association consists of the name, purpose, types of shares, and amount of capital of the company. It is usually prepared with the help of a lawyer. Table 2.2 shows the components of the memorandum of association.

Table 2.2: Components of the memorandum of association

1. Name clause:

The name should be unique and must be differentiated from other existing registered business names.

2. Place of operation/address/situation/location clanse.

Information on the registered office where the books of accounts will be kept and physical address is also added under this clause.

3. Objective clause:

The aims and objectives of the company are stated here. It includes both primary and secondary goals.

4. Capital clause:

(a) Information on the authorised or registered capital of the business is provided.

(b) Information on the amount of share capital, the unit into which share capital is divided and types of shares to be issued (common or preference share).

Note: The capital clause can be altered only after a meeting of the shareholders and agreeing on the alterations by their majority (above fifty-one per cent), Information on the extent of liability to the owners is provided in this clause.

6. Declaration clause:

Declaration of the promoter or owners of the business on their desires to establish the business.

Articles of association

Articles of association outline the internal rules and regulations goveming the management and operation of a company. These rules detail how the company will be operated, including procedures for directors’ appointments, meetings, issuing shares, and distribution of profits. Articles of association work in concurrence with the memorandum of association to provide a thorough framework for the company’s structure and governance. Table 2.3 shows the components of the Articles of Association.

Table 2.3: Components of the articles of association

1. Organization structure.

2. Powers and rights of each shareholder including the founder or owners of the company, and the power of the board of directors.

3. Election of the management committee.

4. Organisation meetings.

5. Information on business financing sources.

6. Company accounts and records.

7. Management salary.

8. Information on borrowing, dividend, and reserve policy.

9. Information on transferability of shares.

10. Information on book-keeping and auditing requirements.

11. Information on altering capital.

12. Information on the qualifications, duties, and power of directors.

Company’s management

Company management involves an interaction among company’s key stakeholders such as shareholders, directors, and workers. Managing a company involves

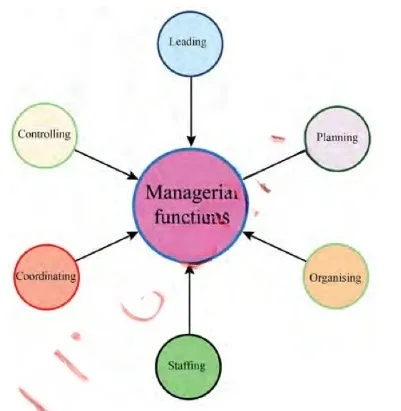

a dynamic interplay among these key stakeholders each playing a crucial role in steering the company towards achieving its goals. The company’s management functions include planning, organising, staffing, controlling, coordinating, and leading as shown in Figure 2.2. These functions work together to achieve or realize the company’s objectives.

Planning: Planning is a basic function of management that focuses on setting up the courses of action that facilitate pre-determined goals of the company. It informs about what is to be done, when it should be done, and the way it should be done in realizing the company’s objectives. Planning plays an important role in the future of the company as it aims at underlining the best ways of utilizing company’s resources effectively.

Organising: Organising refers to a process of identifying and pooling together the necessary resources such as human, physical, and financial resources which are required in the implementation phase for achievement of company goals. Organising as a function of management helps in identifying different activities and responsibilities to be undertaken by different units within the company as well as the individuals or employees involved in the realization of the company objectives.

Staffing: Staffing as a function of management is focused on the process of how the right employees for the right positions are recruited as well as proper allocation of roles or assignments to the right individuals. Also, staffing is involved in the development of employees through training, allocation of remuneration and other benefits that may facilitate employee’s performance.

Coordinating: Coordinating ensures that different departments and groups work in collaboration. Coordination signifies the conscious and rational process of pulling together the different parts of an organisation and unifying them into a team to achieve predetermined goals in an effective manner. It is said to be the essence of management since it binds all the other functions of management. It comprises of integration, unification, harmonisation, and synchronisation to provide unity of action for pursuing common company goals.

Controlling: Controlling ensures that activities are executed in line with the company’ objectives. The controlling process plays an important role as it helps to set standards of measuring performance against set objectives. Through controlling, evaluation of the performance of the pre- determined to what extent the progress has been made. This information is important as it informs the management on issues that may need intervention by adjusting or correcting any deviation where necessary.

Leading: Leading refers to a process of inspiring workers and influencing the way they operate and relate to each other in implementing the company goals. It focuses on how people or groups of people who are tasked to undertake activities within the company are to be guided, motivated, and supervised to realize organisational objectives.

Despite the company’s management functions, the success of a company depends on the collective efforts of its key stakeholders such as shareholders, board of directors, and workers; who have to work in harmony towards shared goals and aspirations as follows:

(a) Shareholders: These are the owners of the company who are driven by the desire to maximise their investment returns. They elect directors and entrust them with the task of corporate governance on their behalf.

(b) Board of directors: These serve as the highest organ of the company which provides guidance and leadership to management. Directors are responsible for making strategic decisions that not only safeguard the interest of the company but also enhance shareholders’ value. Through their oversight role, directors make sure that the management team operates in line with shareholders’ interests in ensuring corporate objectives are met. They establish the organisational culture, ethics, integrity and foster conducive environments for sustainable growth.

By setting clear policies and objectives, the board of directors provide a framework for effective strategy execution. They monitor the company’s affairs and ensure compliance with legal and regulatory requirements while mitigating risks.

Regular board of directors’ meetings serve as platforms for reviewing performance, assessing risks, and charting the courses of actions for the future of the company.

During board meetings, directors engage in strategic discussions to scrutinize reports, evaluate trends, and approve major initiatives. By engaging in strategic discussions and decision- making processes, they ensure that the company remains co-operative and responsive to the changing market conditions.

(c) Workers: These are the employees at all levels of the company. They play a significant role in translating strategic objectives into tangible outcomes. They are the key driving force behind operational excellence, innovation, and customer satisfaction of trust, collaboration, continuous learning, and recognition by providing incentives based on the performance of individuals or groups of people. By so doing, management can enhance workers’ engagement and productivity, eventually driving revenue growth and profitability of the company.

Winding up of a company

A company as an artificial person can die just like a natural person. Winding up of a company means closing down the business. That is, the life of the company comes to an end or ceases to operate. As the birth of the company was enabled by law, the death will as well be affected by the law.

Therefore, legal procedures must be followed during the winding up of a company. Examples of circumstances under which the company may be wound up include conflicts between shareholders, poor management of the company, and company becoming bankrupt.

Activity 2.2

With the help of reliable sources:

(a) Identify the companies that existed in Tanzania and collapsed or ceased to operate;

(b) Explain the reasons for the collapse of the companies identified in part (a); and

(c) Suppose you were the owner of those companies what would you do to revive them?

Exercise 2.2

1. Mr. EGM completed Form IV in 2004. Since then, he has been employed in his brother’s restaurant as a manager. Now, he would like to establish a company that will supply home appliances. However, he is not well informed on the basic requirements for company formation. How can you help him?

2. As a knowledgeable person in company management, how would you articulate the mechanisms through which shareholders influence decision-making processes within a company?

3. Suppose you are a worker of a particular company:

(a) How will you perceive the key responsibilities of the board of directors in corporate governance?

(b) How will you contribute to ensure accountability, transparency, and direction within the company?

Franchise

A franchise is a business in which the owner of a business system (the franchisor) grants an individual or group (the franchisee) the right to run a business using the franchisor’s business system for a fee and/or some share of income generated. Franchisees are also permitted to use the franchisor’s branding, trademarks, and identification marks under specified guidelines.

It is important for anyone planning to start a business by becoming a franchisee to remember that in franchising, the franchisee is bound to an agreement with the franchisor for a defined period.

Franchising is meant to spread business in areas where the original owner is unable to reach. Some examples of the franchises found in Tanzania include; Kentucky Fried Subway which are American fast-food chains that are operating in Tanzania.

Advantages of franchise

The following are the advantages of the franchise:

Business operations assistance: Depending on the terms of the franchise agreement and the structure of the business, the franchisee might receive significant assistance in business operations. The assistance may be in form of equipment, supplies, marketing support or plans to operate the business.

Profit: In general, franchises receive higher profits than independently established businesses. Most franchises have recognizable brands that bring customers from different countries. This popularity results in higher profits.

Customer base: Franchises have access to instant brand recognition and a loyal customer base. Even if the branch of a franchise is opened in a small town, the likelihood is that potential customers are already familiar with the brand from exposure to commercials or travel to other cities.

Ease of securing finance: An already established brand in franchising makes it relatively easier to secure finance from lenders due to brand awareness.

Less risk of failure: Since the franchisee operates a business that has been tested already in the market and has a known brand, all these create a favourable business environment for a franchisee to succeed.

Training offered to franchisee: Training provided by the franchisor compensates for the need for experience.

Disadvantages of franchise

The following are the disadvantages of the franchise:

Little room for creativity: Franchisees are not entirely in control of their businesses, they cannot make decisions on producing or delivering products the way they prefer

without approval by the franchisor.

Higher initial cost: The initial cost in most franchising agreements is relatively high. This may be a disadvantage for small businesses as they need to meet some compliance costs in the country where the franchisor needs to operate in.

Potential for conflict: While one of the benefits of owning a franchise is the network of support received from the franchisor, it also has the potential for conflict. This is because any close business relationship can result in misunderstanding, especially when there is an imbalance of power among the parties involved. At times the parties may not be able to get along in such circumstances.

Risk from other franchises: Failure of one franchise may cost other franchises as the investor may lose an entire chain of investments due to poor image of any one of the franchises.

Lack of financial privacy: The franchise agreement will likely stipulate that the franchisor can oversee the entire financial ecosystem of the franchise. This lack of financial privacy can be seen by the franchisee as a disadvantage. However, it may be less of an issue if financial guidance is welcomed.

Activity 2.3

Use any reliable source to identify franchises available in Tanzania and explore the benefits of those franchises to the community and economy.

Exercise 2.3

1. How does franchise differ from other forms of business unit?

2. Describe the challenges encountered by franchises in Tanzania.

Joint ventures

Joint venture is when two or more companies form or create a single legal entity in which each party owns shares in the newly formed company. It is aimed at pursuing a common goal for a specific period where the enterprise’s risks and rewards are also shared according to agreement by the involved parties. Motivation for forming a joint venture includes business expansion, product development, and product expansion into new markets, particularly internationally.

A joint venture provides the business with several benefits including more financial resources, more management capacity, more technical know-how, access to well established markets, and means of distribution.

Features of joint ventures

The following are the features of joint ventures:

Agreement: Two or more companies agree to undertake a business for a definite purpose and are bound by it.

Joint control: There exists a joint control of the co-ventures over business assets, operations, administration, and even the venture.

Pooling of resources: Firms in the joint venture pool their resources, which help in large-scale production including capital, manpower, technical know-how and expertise.

Sharing of profit and loss: The co-ventures agree to share the profits and losses of the business in an agreed ratio mostly depending on the amount of capital contributed by each party. The computation of the profit and loss is usually done at the end of the business venture. However, where the business continues for a long duration, the profit and loss are calculated and shared annually.

Access to advanced technology: By entering into joint ventures, companies get access to various techniques of production, marketing, and doing business, which

decrease the overall cost and also improve the quality of products.

Dissolution: Once the term or purpose of the joint venture is complete, the agreement comes to an end, and the accounts of the co-ventures are settled as when it is dissolved.

Advantages of joint ventures

The following are the advantages of joint ventures: Access to new markets: A joint venture agreement provides an opportunity to access new markets and distribution networks. This in turn enhances sales of the products rendered by the new joint venture firm.

Enhance business growth: Joint venture arrangement helps businesses to grow faster, increase productivity, and generate greater profits as it brings companies together with their resources including networks.

Provides access to more resources: When two or more companies agree on a joint venture, it means they are pooling together the resources including technology and staff to an established venture. This is advantageous in combining expertise, knowledge, and technology in offering better services.

Flexibility: Being a temporary contract between participating companies, a joint venture can dissolve at any specific future date or when the project is completed.

No loss of identity: Each company can maintain its own identity and can easily return to normal business operations once the joint venture is complete.

Economies of scale: Joint ventures help organisations to scale up with their limited capacity. The strength of one organisation can be utilised by the other. This gives a competitive advantage to both the organisations to generate economies of scale.

Minimisation of risk: Joint ventures tend to share risks between the companies involved in the agreement. This in turn helps to minimise the overall risk of the venture.

Disadvantages of the joint ventures

The following are the disadvantages of the joint ventures: venture may result in more complex tax arrangements especially when the joint venture inyolves companies from different countries.

Political risk: Joint ventures formed by companies from different countries may involve high political risks especially if the wrong partner is chosen.

Unequal involvement: Equal pay may be possible, but it is extremely unlikely for all the companies working together to share the same involvement and responsibilities.

Clash of cultures: Companies involved in the joint venture agreement may have different beliefs, tastes, and preferences which may lead to poor cooperation and integration. This may undermine their profitability.

Activity 2.4

Based on the context of Tanzania, review different literature on joint ventures from reliable sources, then:

(a) Describe the process of forming a joint venture.

(b) Discuss the reasons for the success and failure of the joint ventures.

(c) Explain what you could do to ensure that, the joint ventures succeed.

Exercise 2.4

Collaboration is one of the important aspects of the success of any business.

Briefly explain the benefits of jointly owned businesses.

Co-operatives

Co-operative organisations also known as co-operative societies are voluntarily formed by individuals with common interests of pooling resources to promote

their welfare.

In Tanzania, co-operative organisations started during the colonial period. Co-operative organisations differ from other major forms of organisations since they are set not for profit earning but to promote the welfare of their members. Co-operative organisations are characterized by “Each for all and all for each” philosophy meaning that, everybody benefits from acting collectively.

Examples of co-operative organisations in Tanzania include: Savings and Credit Co-operative Societies (SACCOS), Kilimo Fursa Co-operative, and Agricultural Marketing Co-operative Society (AMCOS).

Features of co-operatives

The following are the features of co-operative organisations: Voluntary membership: Co-operative organisations are formed by voluntary membership. A person who shares similar interests and is willing to follow a society’s norms has the right to join the society, and become a member.

Finance: Co-operative organisation members contribute to the finances of a co-operative organisation by purchasing shares or periodic compulsory savings. The government also may provide financial assistance in the form of state and central co-operative bank loans.

Democratic control: Co-operatives are controlled democratically. The business of a co-operative organisation is generally managed by a committee elected by the members at an annual general meeting. Regardless of the number of shares, all members have the same voting rights and power. “One man one vote” is the basic element of co-operative democracy in making decisions pertaining to co-operative operations and welfare.

Surplus distribution: Like profit-oriented businesses, a co-operative organisations’ surplus is distributed to members in proportion to their capital contribution or an agreed ratio. At least twenty-five per cent of profit must be allocated to the general reserve according to the law. Similarly, a portion of the proceeds (not to exceed ten percent) may be used for the general welfare of the community.

Service motive: A co-operative organisation is created with the primary goal (motive) of delivering beneficial services to its members and society, whether in the form of credit, consumption items, or input resources.

Education and training: A co-operative organisation may provide education and training to its members with the aim of developing the skills of its members for the growth of the co-operative organisation.

Solidarity: Co-operative organisations are formed by people with common interests. The members of co-operative are united while making any decision regarding their welfare.

Formation of co-operatives

Co-operative organisations are registered under the Co-operative Societies Act of the year 2013. The Tanzania Co-operative Development Commission (TCDC) is

the registrar of all co-operative societies in Tanzania.

The following are the procedures to register a co-operative organisation:

Making voluntary decision: Individuals must voluntarily decide to form a co-operative society and inform the co-operative officer within their location about their aim of establishing a co-operative.

Holding a general establishment meeting: Individuals intending to start a co-operative organisation must hold a general meeting that will be chaired by the co-operative officer. The agenda for the meeting will among others include:

(a) The goal of starting the co-operative organisation.

(b) Appointment of members to form the founding board of the co-operative organisation.

(c) Appointing the board leaders.

(d) To inform members about procedures for the establishment of the co- operative organisation.

(e) Delegation of powers and responsibilities to the founding board until the co-operative organisation is registered.

(f) Proposing the name of the co- operative organisation, fees, and

Holding a general meeting to discuss the board’s recommendations: The founding board is required to call a meeting with the founders to discuss and approve the constitution, budget, business plan, and the will to start the co-operative organisation.

Applying for registration: The application will be sent to the assistant registrar of co-operatives at the regional level. Upon satisfaction, the registrar must issue a certificate of registration within sixty days.

Holding a general meeting after registration: The meeting must be held within two months for handing the registration certificate to members, dissolving the founding board and appointing the management board, receiving directives from the registrar of co-operatives as well as setting strategies to attain co-operative objectives.

Types of co-operatives

Co-operatives are divided into two main categories, according to membership registration and the services they provide. The two categories are further explained

as follows:

i. According to membership registration

The co-operatives that are registered according to membership registration are categorised as follows:

Primary co-operatives: These are co-operatives in which all the members are individuals in a local area like a village, ward, or council. It takes a minimum of five individuals. The main purpose of establishing these primary co-operatives is to provide goods and services to the customers at reasonable cost, hence improving standard of living. These co-operatives also, provide employment opportunities or services to its members and promote development.

Secondary co-operatives: These are co-operative societies in which they operate at the district or regional level. These co-operatives aim to provide services to primary societies.

National co-operatives: These are co-operative societies that operate within the boundaries of a certain nation. The main objective of national co-operative is to develop and strengthen the co-operative movement in order to play a leading role in poverty eradication, employment creation and socio-economic transformation in the nation.

International co-operatives: These are co-operative societies that operate among countries. They are located in many countries. The main objective of international co-operatives is to promote the world co-operative movement, promote and protect co-operative values and principles, and facilitate the development of economic and other mutually beneficial relations between its member organisations. For example, the African Cashew Alliance (ACA).

ii. According to the services they provide

The co-operatives that are registered according to the services they provide are:

Marketing co-operative societies: These are co-operative societies in which the main objective is to market the products of its members. These are also known as producer co-operative societies such as Agricultural Marketing Cooperative Societies (AMCOS).

Saving and Credit Co-operative Societies (SACCOS): These are co-operatives whose main objective is to make their members save. They also offer credits to their members.

Consumer co-operatives: These are co-operatives whose main objective is to protect consumer in terms of price variation and improvement of the welfare of the consumer. For example, the Tanzania Consumer Advocacy Society (TCAS).

Transport co-operatives: These are co-operative societies whose main objective is to deal with the welfare of the transport industry, For example, the Tanzania Bus Owners Association (TABOA).

Handcraft co-operatives: These are co-operatives that deal with the welfare of handcraft dealers. For example, the Tanzania Handcraft Association (TanCraft).

Multipurpose co-operatives: These are co-operatives that serve different purposes of the members.

Farm products co-operatives: These are co-operatives that deal only with the farm producers and their products such as Kilimanjaro Native Co-operative Union (KNCU).

Advantages of co-operatives

The following are the advantages of co-operatives:

Easy formation: The formation of a co-operative organisation is considered easy as there is always a co-operative officer in place to assist and provide guidelines.

Freedom of entry and exit: Everyone who is interested can join a co-operative organisation. A member can be anyone who shares a common interest. The membership price is maintained low so that everyone can participate in co-operative organisations and benefit from them. At the same time, any member of a co-operative organisation who wishes to leave is free to do so.

Promotes democracy: All members of co-operative organisations have equal rights and power regardless of their shares. Co-operative organisations allow anyone to join, leave, choose a leader or be chosen as a leader.

Fair distribution of surplus: The surplus generated by co-operative organisations are distributed amongst members fairly; as a result, everyone in the co-operative organisation benefits. Furthermore, co-operative organisations benefit the community since a portion of the surplus, not exceeding ten per cent can be used to improve the welfare of the community in which the co-operative organisation is based.

Limited liabilities: A co-operative members’ liability is restricted to the amount of shares they have contributed. A co-operative organisation member cannot be held individually accountable for the organisation’s liabilities.

Going concern: A co-operative organisation continues to operate for a long time regardless of the death, insanity, or insolvency of any of its members. This

is because those events have no bearing on its continuation as they are treated separately from co-operatives that assumes independence.

Possess some distinct set of interests: Co-operative organisations operate in a small geographic area, and members have a stronger sense of shared interests. Members can communicate with one another work together and handle organisation activities more effectively.

Attract government assistance: The government can provide full assistance to co-operative organisations to encourage their growth. Assistances given by the government may include offering low- interest loans, as well as subsidies and other benefits.

The elimination of middlemen: Co-operative organisations have direct contact with both producers and final consumers. As a result, they are not reliant on middlemen and may save the earnings that the middlemen enjoy.

Provide credit to its members: People have been liberated from informal money lenders by co-operative groups. Informal money lenders charge large interest rates, and the peoples’ income is largely utilised to pay the interest. Co-operative organisations have benefited large population by providing loans at lower interest rates to their members.

Contribution to agricultural development: The government’s efforts to enhance agricultural production have been complemented by co-operative organisations. They have enhanced people’s lives in the rural areas and they are always accessible for help..

Offer reasonable prices and high-quality products: Co-operative organisations purchase and sell large quantities of goods directly from producers and to customers respectively. Fair prices and high-quality products offered by the co-operative organisations ensure market satisfaction.

Social benefit: Co-operative organisations have a significant role in influencing societal norms and reducing wasteful spending. The co-operative organisation profits are utilised to improve the welfare of their members.

Disadvantages of co-operatives

Despite its numerous advantages, the following are some of the disadvantages of co-operatives:

Limited financial resources: Co-operative organisations are always operating on limited financial resources resulting from low membership dues (fees). This leads to a low accumulation of financial resources which in turn results in a failure of the co-operative organisations to achieve intended goals and objectives.

Reliance on government funds: As co- operative societies fail to raise funds on their own, they sometimes rely on government assistance. Heavy reliance on government assistance may result in the inability to properly plan their activities. This is because in most cases the government subsidies do not come on time as expected.

Lack of administrative skills: Co- operative organisations are managed by the committee elected by their members. These members may not have the required qualifications, skills, or experience. Since co-operatives have limited financial resources, their ability to recruit employees is limited. Therefore, they cannot employ the most talented personnel. As a result, lack of managerial skills leads to inefficient management, poor functioning and difficulty in achieving objectives.

Misuse of funds: If the members of the managing committee are corrupt, they might misuse the funds of the co- operative organisation. Many co-operative organisations have faced financial difficulties and closed down because of corruption and misuse of funds.

Possibility of conflicts among members: Co-operative organisations are based on the principles of co-operation and therefore, harmony among members is

important. But in practice, there might be internal politics, differences in opinions, and quarrels among members which may lead to disputes. Such disputes may affect the general functioning of co-operative organisations.

Activity 2.5

Consult local government leaders or any other persons concerned with co-operatives existing in the community. Based on the discussion with that person, explain how the co-operatives benefit their members and the community.

Exercise 2.5

1. How co-operatives differ from joint ventures?

2. With vivid examples, explain different types of co-operatives.

3. Co-operative organisations have no significant contributions to the welfare of their members. Discuss this statement.

Skills lab activity

Suppose that the majority of the newly established businesses in Tanzania normally fail in the early stages to achieve their intended objectives. As a Business Studies student, how can you help the owners of those businesses to re-establish and sustain their operations?

Project work

Select and analyse case studies of successful and unsuccessful franchises in the context of Tanzania. Prepare a report about the key factors that contributed to the success or failure of those franchises.

Chapter summary

1. A business unit is an organisation, enterprise, or firm that deals with the production, distribution, and exchange of products for the purpose of making profits.

2. Business units are classified in different ways depending on their, size, ownership, and industry sector.

3. According to size, business units in Tanzania are classified into micro, small, medium, and large enterprise.

4. According to ownership structure, business units are classified into two forms of ownership, that is public and private.

5. A company is a corporate association of persons formed to carry out certain specific functions with the aim of making profit. Companies can be classified based

on the nature of capital, ownership, control or holding, access to capital, and other basis.

7. Franchising is a business system in the form of marketing and distribution in which the owner of a business system (the franchisor) grants an individual or group of individuals (the franchisee) the right to run a business using the franchisor’s business system.

8. A joint venture is a union between two or more companies that pool their resources and expertise to pursue a common goal for a specific period where the enterprise’s risks and rewards are also shared.

9. Co-operatives are voluntary organisations that are formed by individuals to achieve common goals or for the common interests of their members.

Revision exercise

1. Describe various categories of SME in Tanzania.

2. Your father wants to establish a company and he was told that, the company will have limited liabilities. However, he is not aware of either limited or unlimited liabilities. Briefly explain to him the concepts of limited and unlimited liability companies and their differences.

3. The presence of companies in any country contributes a lot to the growth of its economy. Justify.

4. Explain the legal and regulatory requirements for the formation of a company.

5. Suppose that you are invited to participate in an annual youth meeting. Through their invitation letter, you are requested to talk to the attendees on the basic requirements for company formation. Briefly explain the required documents for company registration as part of your presentation.

6. Suppose you are a shareholder in a certain company, what initiatives would you propose to empower workers within a company and enhance their engagement, productivity, and satisfaction?

7. Assume that you are a director of a certain company. In your capacity, how will you prioritize the agenda for board meetings to ensure they serve as effective platforms forstrategic discussions, decision-making, and oversight in company management?

8. Describe the role of co-operatives in fostering local economic development.

Leave a Reply